Prof. Abderahmane EL ARABI

Faculty of Juridical, Economic and Social Sciences

Mohammed First University

Interdisciplinary Laboratory of Economics, Econometrics and Managerial Research

a.arabi@ump.ac.ma

00212670100409

Prof. Ghizlane CHOUAY

Faculty of Juridical, Economic and Social Sciences

Mohammed First University

Laboratory of Interdisciplinary Studies and Research in Entrepreneurship Territory

g.chouay@ump.ac.ma

00212673795778

Abstract:

The Report on the New Development Model in Morocco recommends the definition of monetary and banking policies, in particular through the conduct of monetary policy which reconciles in a more balanced manner the objectives of growth and inflation under a dual mandate. These recommendations are inspired by neo-liberal ideals which have found expression (in the prescriptions of organizations such as the IMF, the WTO, the World Bank, and other Central Banks) with the institutionalization of a form of capitalism focused on finance and macro-economic balances. These major trends, by limiting the choices of economic policies, ultimately impose predefined trajectories and determine the orientations of Development Models.

Our idea is to see if it is possible to “neo-liberalize the social order”? To promote social justice in a neo-liberal economic order? In dissecting certain neo-liberal concepts, the objective is twofold:

* Highlight the degree of credibility and the real consequences of what is the basis of the functioning of the neo-liberal model advocated, namely the rule of private appropriation of “utilities” exchanged on the market with a trickle-down economy.

* We will endeavour, moreover, to demonstrate the limits of standardization and financial mimicry, recommended by the Moroccan Central Bank, and more particularly, through its recommended monetary policy. The objective is to see to what extent it would be possible to remedy macroeconomic imbalances with the attenuation of social inequalities, in the case of Morocco. Our starting point is axis 1 of the National Report on the new development model and in particular strategic choice 4 “a macroeconomic framework at the service of development”.

Keywords:

Development model in Morocco, macro-economic framework, inclusive growth.

النموذج “النيوليبرالي” المغربي بين العقيدة الإيديولوجية والديماغوجية والمعرفة العلمية: من أجل إعادة ترتيب أولويات القضايا

البروفيسور عبد الرحمن العربي

كلية العلوم القانونية والاقتصادية والاجتماعية

جامعة محمد الأول

مختبر متعدد التخصصات للاقتصاد والاقتصاد القياسي والبحوث الإدارية

البروفيسور غزلان الشوي

كلية العلوم القانونية والاقتصادية والاجتماعية

جامعة محمد الأول

مختبر الدراسات والأبحاث متعددة التخصصات في منطقة ريادة الأعمال

الملخص:

يوصي التقرير حول النموذج التنموي الجديد بالمغرب بتعريف السياسات النقدية والمصرفية، لا سيما من خلال إدارة سياسة نقدية توفق بطريقة أكثر توازنا بين أهداف النمو والتضخم في إطار ولاية مزدوجة.

هذه التوصيات مستوحاة من المثل الليبرالية الجديدة التي وجدت تعبيرا عنها (في وصفات منظمات مثل صندوق النقد الدولي، ومنظمة التجارة العالمية، والبنك الدولي، والبنوك المركزية الأخرى) مع إضفاء الطابع المؤسسي على شكل من أشكال الرأسمالية التي تركز على التمويل والاقتصاد الكلي. التوازنات الاقتصادية. هذه الاتجاهات الرئيسية، من خلال تقييد خيارات السياسات الاقتصادية، تفرض في النهاية مسارات محددة مسبقًا وتحدد توجهات نماذج التنمية.

فكرتنا هي معرفة ما إذا كان من الممكن “تحرير النظام الاجتماعي الجديد”؟ لتعزيز العدالة الاجتماعية في النظام الاقتصادي الليبرالي الجديد؟ في تشريح بعض المفاهيم الليبرالية الجديدة، يكون الهدف ذو شقين:

*تسليط الضوء على درجة المصداقية والعواقب الحقيقية لما هو أساس عمل النموذج الليبرالي الجديد الذي يدعو إليه، أي قاعدة التملك الخاص لـ “المرافق العامة” المتبادلة في السوق مع الاقتصاد المتدفق.

*علاوة على ذلك، سنسعى إلى توضيح حدود التوحيد والتقليد المالي، الذي أوصى به البنك المركزي المغربي، وبشكل خاص، من خلال سياسته النقدية التي أوصى بها. والهدف هو معرفة إلى أي مدى سيكون من الممكن معالجة الاختلالات الاقتصادية الكلية من خلال تخفيف الفوارق الاجتماعية، في حالة المغرب. نقطة انطلاقنا هي المحور 1 من التقرير الوطني حول النموذج التنموي الجديد وخاصة الخيار الاستراتيجي 4 “إطار اقتصادي كلي في خدمة التنمية”.

كلمات المفاتيح:

نموذج التنمية في المغرب، إطار الاقتصاد الكلي، النمو الشامل.

Introduction

A development model is “a frame of reference for those responsible for developing a country’s public policies” (UNDP, 2019). Economic policy, which underlies the model, must be a set of coherent decisions which, with the help of various instruments (of knowledge and intervention) aim to achieve a certain number of previously established objectives. So overall consistency (with defined objectives) is essential even if it is a source of intellectual destabilization. A New Development Model (NDM) is not simply an economic system that needs to be adjusted to take account of certain irregularities in the failing functioning of the market; It is a societal model of a fair society. However, the flower does not grow on concrete. The development model has run out of steam, in a context dominated by the shared observation of a “crisis” of confidence in people and political institutions, in progress, in the economy, etc. It is a recognition of the failure of “a model”. “Our system” creates inequalities, it is not inclusive through work…

Axis 1 of the National Report on the NDM recommends “a productive, diversified economy that creates added value and quality jobs” and strategic choice 4 specifies that this must be done in “a macroeconomic framework at the service of development”.

What macroeconomic framework would then be best able to ensure this inclusive growth?

Knowing that in economics, the new models rarely supplant the old ones, and for the success of this project, can we continue to draw inspiration from the neo-liberal model – i.e., monetarism and related theories – valuing private interest? Recall that the concept of neo-liberalism describes “monetarism which has a strong preference for a State which intervenes in the market only to preserve the market economy with a monetary policy aimed solely at price stability” (Ver Eecke, 1982).

Can the state, by planning for the market and institutionalizing a social order that supports market norms and practices, foster this inclusive economy? What is the effectiveness of the trickle-down policy – the Track Down Economics…- advocated by neoliberals, supposed to improve the standard of living of all individuals in the long term? Does this dynamic of private capital accumulation inevitably lead to an ever-increasing concentration of wealth and power in a few hands, as Marx believed in the 19th century? Or do the balancing forces of growth and competition lead spontaneously to a reduction in inequalities, as Kuznets thought in the 20th century? (Piketty, 2013).

If the remedies proposed by the NDM are numerous, they appear to us – at the level of the axis studied – in harmony with a certain dominant thought in Morocco which consists of:

– to consolidate the stability of the macro-economic framework by favouring balances,

– strengthen the efficiency of the financial sector.

In such a context, how then to reconcile between the stability of the macro-economic framework, a revival of growth and a policy of attenuation of the social deficit?

In terms of methodology, and to clarify our epistemological position, the first part will deal with the neo-liberal economic policy project that has shaped the economic landscape in Morocco since independence and continues to shape it ever since.

At the level of the second part, we will discuss the different levers to initiate the start of the NDM to say that one cannot apply a pattern of standards to a different structure in a specific historical context. The absence of a strategic vision, disharmony, incoherence and the absence of transversality risk disrupting the NDM.

I: The legitimization of a dominant neo-liberal “thought”

Even though it is “impossible to define neoliberalism purely theoretically” (Filho & Johnston, 2005), and across its various articulations, neoliberal regimes are consistent in asserting economic efficiency as the primary calculus of public value (Gide,1898;Cros, 1950). Even integrating a perspective on moral virtue, cases of social inequality and injustice would be morally acceptable insofar as they are considered the consequence of rational choices and decisions freely initiated by individuals. To require the state to regulate the market or to compensate would be morally depraving for an individual in a totalitarian state. Investing in the performance of social systems is seen as non-productive, as a misallocation of resources, as a waste given that these social policies are synonymous with rigid fiscal policies.

Once this postulate is accepted, the conclusions on the factors affecting the development, will be logically accepted (Bourdieu, 1998); Public spending would be responsible for inflation and weak growth. The related economic policies recommended, logically deduced are:

*Reducing the progressivity of income tax systems as a way to stimulate investment and economic activity;

*The allocation of monetary policies (interest rates, etc.) to controlling inflation even at the risk of an acceleration in unemployment; Efficiency and equity are just rhetoric to justify a transfer of resources from the public sector to the private sector;

*The subsidy of the deprived social classes is considered a waste of state resources in non-productive social plans. In the long term, these resources, distributed without counterparts in terms of work effort, will be exhausted in a black hole by sterile behaviours;

* Neo-liberalism is conceptualized with the legitimization of a quasi-monopolistic class dominated by a small number of actors in the market, which obscures the idea of the market and competition. The counterpart of the rule of private appropriation of “utilities” exchanged on the market is the exclusion of all those who do not participate in the exchange.

If we pay attention to the long history of neoliberal thought, as early as the 1920s, neoliberalism was forged in the intellectual atmosphere arguing that the market enables the most optimal form of social order. Von Mises, Hayek, Knight, Polanyi, Friedman and others will formulate, in think tanks such as the Société du Mont Pelerin or the Chicago School of Economics, what was to become the defining issue of neo-liberal thought. For Von Mises (1947), “It is important to understand that Fascism and Nazism were socialist dictatorships”. Recall that Stalin’s motto was “Everything in the state, nothing against the state, nothing outside the state”. For Hayek (1944), market economies have a very efficient coordination mechanism. If the laws of the market are respected, each market constituting the economy (goods and services, labour, capital) is balanced thanks to the free play of supply and demand. With Beveridge (1945), an economy, within the framework of the capitalist system, can be united and efficient. Friedman (1962), advocated that the very role of democracy is to make profits. So, a policy that opposes the interests of the market would be contrary to democracy. The social domain and the distribution of wealth are determined by the sacrosanct market which, moreover, is self-regulating.

With the Washington Consensus crafted in the 1980s, neoliberals would set the global economic and political agenda. Serving the market becomes essential, with a foundation of the State as a facilitator; Facilitating privatization, deregulation, and liberalization… of markets is the determining principle of State policy.

Since Ronald Reagan launched in 1980: “Government is not the solution, government is the problem” (Harvey, 2005), flexible regimes (in the determination of prices on the various markets) have become the norm; In the labor market, it is the productivity of the labor factor that is supposed to determine remuneration. The practical implementation of “neo-liberal” economic ideology implicitly and explicitly assumes that power and wealth are, to an ever-greater extent, concentrated within an elite group; the trickle-down effect is supposed to mitigate the impact of this unequal distribution of wealth.

For Rosanvallon (1981), the State has suffered a crisis of legitimacy: social values have changed… Merit or freedom are more important values than solidarity. More and more individuals are reluctant to pay the price for this compulsory solidarity, the foundation of the welfare state. To incite to be productive, not to waste production goods and not to sacrifice quality; the market stimulation system would be more effective. For Debreu (1984) “The superiority of liberalism has been scientifically demonstrated” (Declaration in the Figaro Magazine).

We cannot, however, be more royalist than the king (or more liberal than the liberals); Hayek and many liberals like Friedman recognize that freedom is zero for those who cannot “have a minimum subsistence level, [to] feel free from elementary physical deprivations” (Hayek, 1944).

II: From Eurythmy to an unjust social state: what levers to initiate the start

Growth strategies will therefore preoccupy economists, as illustrated by the famous controversy between the proponents of balanced growth and those of unbalanced growth. (Brasseul&Lavrard-Meyer, 2016).

“Balanced” growth vs. “unbalanced” growth:

Our reluctance to balanced growth is first reinforced by an observation: The problem of Morocco today is that of poverty, precariousness, unemployment, insecurity… This generates such a feeling of injustice. social that it is necessary to carry out a critical reflection on the manners of managing and allaying the concerns.

Is it still necessary to recall that in Morocco, different scenarios have been “tested” to clean up the economy by the logic of stability of macro-economic aggregates: first a three-year austerity plan (1978-1980), an adjustment program (September 1983), a structural adjustment program, an enhanced structural adjustment program. Then, a consolidation of the structural adjustment program (1992-1994), upgrading policies (from urban upgrading to tax upgrading, etc.), and a human development program… were implemented. And for what result? A moribund rentier and informal economy with disastrous social consequences. In 1995, a report by the World Bank pointed to an inefficient administration, subservient and corrupt justice and a bankrupt education system. In 1997, in a speech by the late Hassan II, “The cuts in social spending will be accentuated…. It is excluded that we can increase our social expenditure… So, let’s remove from our reflection and our programs the idea of wanting to solve the problem of employment by hiring civil servants. In the public service, there is no room for adventure or imagination, just as there is no freedom” (July 8, 1997, on the occasion of Youth Day).

These “strategies” have jeopardized growth prospects (failing public service, unstructured informal sector, erosion of confidence in institutions, etc.). The Gini index of 0.4 shows us that Moroccan society is the most unequal in North Africa.

New “problems” have since appeared. They constitute so many realities to which the legacy of the past does not provide an answer. They require new developments of thought. In 2017, HM King Mohammed IV noted “…We have identified the difficulties that are preventing the evolution of our development model and noted the dysfunctions that are rife at all levels…”. (October 13,

Already in 1978, with a population of 19 million, 68 individuals or families controlled 55% of private industrial capital, a third of which was in the hands of only ten groups.

Funded by the World Bank to the tune of $100 million.

One of the objectives was to contribute to greater social justice (?!) through “the elaboration of a social development strategy for low-income households and redirecting credits for the benefit of the social sectors to further reduce social inequalities…”

2017, on the occasion of the opening of the session of the 2nd legislative year of the 10th legislative). In 2019, nearly 45% of Moroccans considered themselves subjectively poor (38.6% in urban areas and 58.4% in rural areas (National Observatory on Human Development, 2021))while Forbes magazine revealed to us that in 2020, the 15th and 17th rich Africans in particular with 1.7 billion dollars are Moroccans. The Mendras spinning top shows us that in Morocco the richest 10% have a standard of living on average 12 times higher than that of the poorest 10%; Still, no trickle-down effect. “… the progress recorded in Morocco does not benefit all citizens…”. According to the High Commission for Planning, the wealthiest 20% of Moroccans hold more than half (53.3%) of household income; the bottom 20% hold 5.6% (High Commission for Planning, 2021). The wealthiest 20% of households have an expenditure equivalent to 8.8 times that of the poorest 20% of households; a gap that has hardly diminished since the 1990s. In 1985, the richest 20% were responsible for 47% of consumption. In 1999, these 20% were responsible for 47% of consumption; the bottom 20% were only responsible for 6.5% (Pennell, 2000). Under these conditions, income inequality, estimated by the GINI index, is 46.4% exceeding the socially tolerable threshold (42%).

“… We note with annoyance that in certain social sectors, the balance sheet and the reality of the achievements are below expectations… Human and territorial development projects which have a direct impact on improving the living conditions of citizens do not do us any honour. This state of affairs is essentially due … to the absence of a national and strategic vision, but also to the fact that disharmony prevails over coherence and transversality, that passivity and procrastination replace the spirit of initiative and concrete action. …” (Royal speech on the occasion of the 18th anniversary of the accession to the throne).

The break between the social and the economic has gradually been consumed and there is a risk of a social fracture. “The participants, all categories combined, express concerns amplified by a feeling of economic, social and legal insecurity” (NDM Report; 24). With such a diagnosis, and instead of persisting, in a neo-liberal logic, in preserving the balance, it seems obvious that it is necessary to put in the crosshairs precariousness, poverty, unemployment and social exclusion.

12.6% of Moroccans approach the multifaceted poverty line and 4.9% live in extreme multidimensional poverty…

Exclusion in Morocco refers to a process of social disqualification and social disaffiliation that can lead (which leads) to a crack in the relationship between the individual and society. We have about 250,000 graduates every year while, at the same time, the labour market provides only 100,000 jobs. Data collected by the High Commission for Planning indicates that between the 1st quarter of 2019 and the 1st quarter of 2020 (not including the effect of the pandemic), the national economy created 77,000 jobs; the unemployment rate thus worsened from 9.1% to 10.5%.

Under these conditions, it is “normal” for a vicious circle of exclusion to be triggered; More than nine out of ten Moroccans (91%) would not hesitate for a second, if given the opportunity, to go and work abroad, according to the latest survey by Jobboard Rekrute.com (2018) (the survey was carried out among holders of a Bac + 3). Furthermore, the NTIC Federation estimates that 8,000 senior executives in the private and public sectors emigrate annually (El Yazami & Jamid, 2021). According to the report of the World Labor Organization, Morocco occupies the 3rd place in the world in terms of brain emigration. 80% of Moroccan workers would like to work outside Morocco according to the Global Talent Survey, which covered a sample of more than 360,000 people in 198 countries, including 6,721 Moroccans (Mseffer, 2020). This percentage is well above the world average, which is 57%. “More than 600 engineers leave the country every year as part of the scourge now known as the brain drain” (Saïd Amzazi, former Minister of National Education, Vocational Training, Higher Education and Scientific Research (January 2019) at the level ofthe House of Representatives). At the same time, the Association of Engineers of the National School of Computer Science and Systems Analysis claimed that, of recent promotions, up to 80% of the winners have been hired by European companies. For its part, the Moroccan Federation of Information Technologies, Telecommunications and Offshoring announces that the IT sector in Morocco is losing 50 engineers every month and that three foreign companies come every two weeks to recruit around ten engineers. Their priorities: access to a more comfortable quality of life, a better work environment… This voting by the foot actually expresses a social malaise.

Citizenship is above all the result of social integration. Precariousness and social disintegration develop a feeling of exclusion: The individual, in a situation of exclusion, does not have the feeling of contributing to the development of the collective heritage (wealth), of contributing to the creation of value … He does not benefit from any share in the distribution of this heritage. However, everyone is convinced that they contribute to social peace and this peace is a source of progress (wealth). Finally, there is no reciprocity of gains; this develops a feeling of injustice which will be a trigger for all forms of violence.

In such circumstances, how then to develop capacities, inclusiveness, solidarity and equal opportunities? We need policies that quell the latent anger that can erupt and explode anywhere, anyhow. It is difficult to ignore and even less rebuke the feeling of injustice reinforced by stories of embezzlement, corruption, situation of rent … for considerations of macroeconomic balance.

, in Morocco, reconcile macroeconomic balances and a proactive investment policy (???)? For the sake of accommodation, the NDM Report recommends “the definition of monetary and banking policies, in particular through the conduct of monetary policy which reconciles in a more balanced manner the objectives of growth and inflation within the framework of a dual mandate (?!). Reading the Report does not reveal how to stabilize the macroeconomic aggregates within the framework of a policy to revive growth and reduce the social deficit. Unwilling (perhaps) not to endorse one or the other of these choices in this confused and conflicting debate, the report translates as “a gesture of compromise”, which, in our view, presents a double threat of a theory cut off from any practical perspective and a practice cut off from any theoretical reflection.

However, the messages of King Mohammed VI (2014) are, however, totally contradictory; “What matters to Me is not so much the balance sheet and the figures, but above all and above all the direct and qualitative impact that the achievements may have had on the improvement of the living conditions of all citizens… I note, during My information tours, certain manifestations of poverty and precariousness, as I note the extent of the social disparities between Moroccans”.

f – among neo-liberals who advocate stability – that the economy has a requirement of performance while the society has a requirement of justice. This belief, that “economic action” and “social justice” would be an oxymoron, anchored the idea that social justice goes against economic efficiency and that the notion of social justice is only an artifice of language with the sole purpose of laying a modest veil over certain practices. Fortunately, one of the main functions of Social Sciences is undoubtedly to flush out false evidence.

Today, – with the defenders of the NDM – the question is no longer whether to reduce the economic deficit or the social deficit; but rather how to achieve growth that reduces the social divide and consolidates the stability of the macro-economic framework.

The following observations attempt to express concern and pose several questions. This contribution does not aim to provide an exhaustive answer to these questions, but rather from observations to stimulate reflection and discussion. Of course, such a reflection goes beyond our capacities alone, and it also goes beyond the available space of this publication.

on would increase in such a situation. Freezing wages would then be necessary to avoid a resurgence of demand-driven inflation and to avoid weighing on wage costs. “The combination of growing central government debt and household indebtedness is structurally weakening the external accounts” (World Bank, 2017). According to the World Bank (2019), “Fiscal adjustment leads to an improvement in fiscal and external balances, reducing Morocco’s financing needs and strengthening the outlook for public debt”. With strong central bank oversight, the financial sector might be healthy; but how to reconcile this objective of reducing financing needs with the objective of a proactive investment policy (recommended by Lekjaa). Bank al-Maghrib would have leeway to contain inflationary expectations as well as a comfortable foreign exchange reserve to protect itself from fluctuations in currency rates; but what about insecurity, poverty and social exclusion? We recognize here the sophism of the free fox in a free henhouse. In our view, the intellectual edifice of such a construction is fragile. The decrease in public finances has had its share in the measures recommended in the education and health sectors; the Covid crisis has revealed glaring shortcomings. These instruments of intervention can support an effort, not replace it. It has been widely abused. We will have to stop focusing on financial games and deluding ourselves to tackle the real problems of our society. An economic policy can only be a trickle-down economy if it is designed to improve the standard of living of all individuals in the long term. “A nation cannot prosper for long when it favours only the haves”(Barack Obama,2009). We will endeavour to highlight the limits of the very theoretical foundations and philosophical underpinnings of such a conceptualization.

First, financial stability is difficult to define and assess. This is due to the complex and cross-cutting interdependencies and interactions that characterize the financial system itself and its links with the real economy (Bank Al-Maghrib, 2016). From a technical point of view, the main difficulties in constructing a financial stability index lie in the choice of economic and financial indicators, in the method of standardizing these indicators to make their aggregation and interpretation consistent and finally in the game of weighting to be used for the calculation of the aggregate index.

Then, growth is reduced only to the progression of economic indicators. Can development only be commercial? To be inclusive, growth must be a global, economic, social, political, and cultural process… which tends to improve the well-being and quality of life of all or most of the population and to the development of the individual. Contrary to what we want to believe, the perceptions and opinions that potential investors have of a country that persists, in all circumstances, in stabilizing, are negative. The proof? At the end of the adjustment programs, investors were not rushing to the door. A reputation based on the growth indicator has a greater economic value than the stability of the aggregates associated with a flagrant social deficit.

Moreover, the question to be asked in the Moroccan context is more complex: How effective can a policy of balancing macro-economic aggregates be in the context of:

* an increasingly strong polarization,

* a lack of transparency and accountability which leads to an erosion of trust in institutions. “…the lack of visibility creates mistrust and a wait-and-see attitude

Several techniques have emerged to assess financial stability; three are widely used in the literature and by central banks, namely macro-stress tests, early warning systems, and financial stability indices. An aggregate financial stability index (IASF) is an aggregate index calculated as a weighted average of 25 macroeconomic and financial indicators, classified into five sub-indices:

*Macroeconomic development,

*Financial development,

*Banking vulnerability,

*The vulnerability of the non-financial sector and

*Systemic risk

that handicaps investment and growth…by creating a discouragement effect among potential new entrepreneurs. This observation is very visible when examining the “fear of failure” indicator of the “Global Entrepreneurship Monitor”, which stands at more than 47% on average over the period 2015-2019 in Morocco, against an average of 37% out of a sample of 50 countries” (Economic, Social and Environmental Council, 2019).

* The questioning of the legitimacy of intermediary bodies,

* an informal economy; the formalization of employment in Morocco is quite a project. The proportion of formally salaried workers has certainly increased, from 29% in 2000 to 45% in 2019; But this means that more than half of salaried workers are still working in the informal sector with, in particular, what this implies as a drop in state tax revenues,

* of a rentier economy,

* an economy of corruption and embezzlement leading to a weakening of social ties,

* an economy of frustration with its physical and moral harm resulting from an unequal distribution of wealth…

There are other economic objectives than the balance of the aggregates. Sustainable development, ethics and even politics thus become economic objectives. Ethical risk cannot be apprehended solely from analyses and economic and financial variables, nor can it be managed solely from insurance contracts or financial products. The human being is not exclusively a resource or a means, a factor of production that must be combined with other inputs in a productive process to generate an output. We cannot approach it exclusively as an abundant factor; his remuneration would therefore be nil.

Moreover, the theories on which the decisions of central banks are based are rejected. “All the theories that underpin monetary policy choices are rejected by the facts and by economic thinking. Central banks cannot rely on any of the usual theories to make their decisions” (Artus, 2021). The absence of a link, in the short term, between the economic situation and inflation calls into question the adoption of restrictive monetary policies when the economy returns to full employment. The absence of a long-term link between monetary policy and inflation calls into question the medium-term inflation objective.

“Monetary policies do not only have macroeconomic effects, on inflation or the economic cycle, but also redistributive effects. They impact inequalities” (Cartapanis, 2021). The question of the inclusion of a new objective, relating to inequalities, in the mandate of central banks must be prescribed.

There will be no social justice and even less inclusion and resilience without a complete overhaul of the way of conceiving society, of conceiving man, of conceiving the economy (Stiglitz, 2010). It is the rejection of “great inequalities” that pushes us to reflect on the basis of standards of justice. It is necessary to reverse a certain number of sequential series. Individualism is not democracy, is not individual freedom. We must reconcile man with wealth.

The Elementary Neo-Classical Theory makes a simple assumption: the sole source of satisfaction is profit and the goal is therefore profit maximization. Therefore, a policy that opposes the interests of the market would be prohibited. The social realm, wealth and distribution of wealth are determined by the market. We are not against the market; it is still necessary to check whether the conditions of “self-regulation” are verified. We are coming to the end of a process in which democracy is increasingly reduced to representative democracy to the detriment of deliberative democracy and participatory democracy, most often emptied of their meaning. However, democracy will only be rehabilitated if these three levers are held at the same time.

Can the Market show solidarity and fight against inequalities, precariousness, poverty and social exclusion? Economist Wittmann (2007) says: “Financial markets have decoupled from the real economy and run their business on their own. The goal is to make as much profit as possible without work…”. According to Alan Greenspan (former Chairman of the US Federal Reserve), … the neoliberal system is a bitter failure because the market cannot regulate itself without state intervention. We talk about Killerkapitalismus. Giulio Tremonti (former Berlusconi’s economy minister from 2001 to 2006), bitterly repented of having served liberalism: “The totalitarian ideology market invented to govern the 21st century, has demonized the State and almost everything public or community, by putting the sovereign market in a position to dominate all the rest”.

The interest of corporate profit is overvalued. For Stiglitz (2002), the so-called “benefits of the effects of growth and economic development on the poor” theory is wrong. Robinson argues for “inclusive” development that corrects this asymmetry (Ignacy Sachs Encyclopedia of Sustainable Development). The “trickle-down” theory would be unacceptable from an ethical point of view. In a society of inequalities, it is absurd to claim that the rich must be even more so that the poor can be “a little” less poor. Moreover, there is nothing to deny that the sum of the profits made by certain agents is not offset by the sum of the losses suffered by other agents. This transfer is therefore a zero-sum game. The economist cannot be this predator of mercantilism. The economy must not forget its human purpose. This obsession risks ruining the economy by emptying this discipline of its meaning and consistency.

In our view, this monomania of stabilizing economic deficits to the detriment of social deficits is “a pathology of reason” which reverses the hierarchy of values, putting society at the service of the economy, itself subordinated to money, when you should do the exact opposite. To persist in stabilizing economic deficits to the detriment of social deficits is a “blind intelligence” which can only widen the social divide when Morocco has the highest level of social inequality in North Africa and … it doesn’t drop. It is a threat to social cohesion. The rupture of the social link is a source of delinquency, violence, and ideological excesses. We are not only creating an injustice; we are creating real problems for the future. It is the social balance that is threatened. Imagine that collective social protests are organized… In the discourse urging balance, there is no requirement or possibility for the concrete promotion of justice in the economic order (Antoine, 1970). No projection towards a “just” society. We ask ourselves in the name of what this model claims to be able to be normative. The current crisis has demonstrated the limits of standardization and financial mimicry. What bothers us in this standardization is this remarkable alliance between disinterestedness and indifference to social distress.

In summary, contrary to this recommended single thought, the man animated by the scientific spirit wishes (without doubt) to know, but it is immediately to better question. It is necessary to specify, to rectify; these are types of dynamic thinking that escape from certainty. In all the rigorous sciences, we are wary of more or less apparent identities, and we constantly demand more precision. Objectively, how does the NDM mark a break with the old development model, able to ensure a certain social justice?

You cannot apply a schema of norms to a different structure in a specific historical context:

The crisis will undoubtedly be a blessing (in disguise) if the world succeeds in transforming the conventional reading grids, the dominant frameworks of thought and the intellectual blockages which have contributed to the collapse of whole sections of the world economy. “Humanity today is in great need of complex ways of thinking to shed light on an almost obscured world through simplistic and simplified approaches. The dangers of the standardization of models and the impasses generated by the consanguinity of ideas, attributable to the complicity, the abstention of the elites… to give a human face to the mutations at work”(HM Mohammed VI, 2009).

Are the indicators used to stabilize the aggregates suited to our economy? These indicators refer exclusively to the monetary and financial situation of the Member States of the European Union for the adoption of the single currency. These are called “convergence criteria”.

a- The public deficit/GDP ratio ≤ 3% (including not only the current budget deficit but also the social accounts and local authorities deficit),

b- Inflation rate: ≤ 1.5%,

c- Debt/GDP ratio ≤ 60%…

Why these numbers? These postulates and axioms serve exclusively to facilitate the formulation and manipulation of models, making logical reasoning or the application of mathematics simpler or simply possible. Let us say right away that the inability of the Stability and Growth Pact to enforce these criteria established in Maastricht necessitated the adoption of the “Fiscal Compact” in March 2012.

a- Public deficit/GDP ratio ≤ 3%

The story of the “3% rule” is comical to say the least (Pommiers, 2018 ;Ecalle, 2019). Originally, it is a French rule created under François Mitterrand. When he came to power in 1981, the first socialist president of the Fifth Republic inherited a public deficit well above what the outgoing majority had announced. However, an increasing deficit (with the State budget registering more expenditure than income), it is a debt that swells. And… an indebted State is a State dependent on the moods of the markets from which it must obtain financing (?!).

François Mitterrand needs a mathematical rule to limit the deficit and justify budget refusals to his ministers. This is the mission given to some senior officials of the Ministry of Finance. One of them, Guy Abeille, wrote in La Tribune in 2010 that no “economic theory [was] there to support [their] constructions, or even to guide [their] thinking”. The ministry decides, for convenience, to create a “deficit/GDP” ratio and determines a rate not to be exceeded. G. Abeille explains as follows: “We look at the most recent GDP forecast projected by INSEE for 1982. We enter into our calculator the spectre of the 100 billion deficit that moves on our desk for the budget in preparation. The ratio of the two is not far from giving 3%”.

Eleven years later, European states are adopting this standard and making it one of the convergence criteria. At the time, economists calculated that with a growth rate of 5% (which they believe could be achieved in the EU), 2% inflation and 3% deficit, the maximum debt is 60 %. These are therefore the objectives that they set for all countries to guarantee the stability of the European economy.

b- Inflation rate: ≤ 1.5%?

Olivier Blanchard, Chief Economist and Director of Studies at the International Monetary Fund, proposed that the benchmark inflation index currently at 2% be increased to 4% i.e., that central banks should only start worrying when this new limit is reached. We would then admit a maximum loss of value of the currency over 10 years of 48% and not more than 22% (Blanchard & Leigh, 2013).

c- Debt/GDP ratio ≤ 60%?

With public deficits, debts have also increased considerably. Contrary to the public deficit, there are few countries that today respect the norm of a debt of less than 60% of GDP; Until the end of the 1990s, excessive external indebtedness was rather confined to certain emerging economies. Since 2001, the pursuit of very accommodating monetary policies, the very low level of global interest rates combined with the abundance of liquidity, have favored the continuation of debt dynamics at historically high levels. Governments, like economies, have thus been able to delay the adjustment of their own spending, allowing their debt ratios to spiral to potentially unsustainable levels. Let’s take two illustrations: the case of France and the United States:

According to the basic scenario of a study by the Congressional Budget Office, the federal debt of the United States could exceed 250% of GDP by 2050. In 2020, the public debt amounts to 28.529 billion dollars for the States United States, or the equivalent of 125% of its GDP and 113% of GDP for Belgium during the same year. On the outlook for French public debt “The continuation of current trends would lead to astronomical public debt ratios: 130% in 2020, 200% in 2030, 300% in 2040 and nearly 400% in 2050. […]” (Pébereau, 2006). During the second half of 2020, the average in the European Union was 98%.

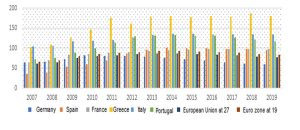

Weight of public debt (within the meaning of the Maastricht Treaty) in the European Union as a % of GDP.

Representation made from data collected from Eurostat

Japan has a debt of 259% of GDP in 2020 which does not worry, in particular because it is held by Japanese.

Admittedly, public debt has a cost; the payment of interest representing, for example, 12.3% of the ordinary expenditure of the Moroccan State in 2020. But it is not only useful, and even essential, when the market is unable to ensure the necessary adjustments; in particular, the market will not be able to finance the generalization of preschool for children.

Why do we criticize these standards?

First, there are criticisms of the very possibility of achieving these goals. In Morocco, the downward revisions of growth forecasts and the high volume of unemployment make additional budgetary adjustments particularly delicate. Morocco does not need another austerity cure. We need a policy of growth and a policy of effort and not a policy of sacrifice; a policy of increasing purchasing power.

For a long time, Morocco has sought to restore its balance by reducing its investment expenditure instead of reducing its current expenditure. Current expenditure can be financed in particular by taxes; investment spending through borrowing.

It is necessary to cut in the unproductive expenses; eliminate waste, combat fraud; increase the productivity of public services … instead of persisting in trying to convince that the stability of macroeconomic aggregates is a source of wealth.

Then the numbers can’t say anything by themselves. It is necessary to wonder about the “structure” of the deficit to know if the imbalance of public finances is due to long-term investments, to operating expenses of the State not covered by the receipts or to embezzlement. It is the same dilemma that arises for a bank: should it rather lend to a company that is self-financing or to another that is already in debt and wishes to take on more debt. As a first approximation, we may be tempted to believe that a self-financing company is a healthy company… We still have to analyze the structure of its debt (from the bottom or from the top of the balance sheet). In national accounts, the main function of a non-financial corporation and quasi-corporation is production. This requires investments and possibly debt if the company masters the market. However, self-financing can come from savings, which is the main function of households; this may suggest that the company is not taking any risks because it does not understand the market well

Furthermore, the implementation of the NDM over the next five years must begin with strong signals that will make the change perceptible, thus making it possible to strengthen the confidence of all the components of the nation. Some recommended actions will require a substantial budgetary effort. The aim will be to give credibility to the approach and to encourage support by taking the first significant decisions and achieving the first rapid successes, demonstrating the evidence of a new inclusive model, directly impacting citizens in their daily lives.

In addition, reducing deficits simultaneously in all countries is the guarantee of a new recession, which can only fuel… deficits and public debts. When the state spends less, the first losers are businesses. The fight against deficits is breaking the recovery and the measures recommended are always the same:

èreduce the cost of labor by reducing labor income,

èfacilitate dismissals,

èreduce corporate tax, etc.

According to Abdellatif Jouahri (Governor of the Central Bank of Morocco), stability/austerity policies could prove favorable to growth, thanks to the confidence they would generate. However, as Krugman (2010) points out, the “confidence fairy”, which must make it possible to make stability/austerity compatible with growth, which would contradict all the basic teachings of macroeconomics, does not exist anymore than the other fairies. Krugman criticized this return to “this form of stability/austerity”. There would be no contradiction between the fact that the state spends more during a recession and then reduces public spending when employment and activity return to their normal level. A stability/austerity policy is incapable of achieving its objectives, since the deep recession it creates reduces public revenues, thereby fueling the deficit and the debt. Since then, the IMF has recognized its error and calls, like the OECD, for an increase in public investment. In a contribution to the debate on the impact of fiscal stability/austerity policies, Olivier Blanchard and Daniel Leigh show that most macroeconomic forecasting models (including that of the IMF) have underestimated the value of fiscal multipliers in Europe (Blanchard & Leigh, 2013).

According to their estimates, the negative effects of stability/austerity policies on GDP, employment, consumption and investment have been largely underestimated by most of the major forecasting institutes (IMF, European Commission, OECD, …).

Conclusion:

The NDM report established a diagnosis; however, the remedies formulated are often imperceptible because it does not decide on the level of economic policies to be adopted.

The challenge for Morocco today is to make a real break not only with the old development model which has shown its limits, but above all with the bad practices of a dominant thought which undermine, until then (and since independence), the rise of the country. Neoliberalism is not only an economic system but also sets itself up as a political and social dogma based on selfishness, individualism and hedonism incompatible with the concerns of Morocco. It generates poverty; exacerbator of precariousness and trigger of exclusion).

*In Morocco, the market is “sterilized” and the “invisible hand” is handicapped. A “neo-liberal” economic policy is not – and cannot be – a trickle-down economy; it does not have an equitable “economic” and social impact by reducing inequalities in terms of distribution. The “inconsistencies” (and resistance) of the equilibrium policies of the aggregates (which have already in the past mortgaged the prospects for development) risk hindering the initiation of the start-up of the operational levers and reserving the same fate for the NDM as the previous reports (Cosef 2000, Cinquentenaire 2005): intense media consumption and selective application of recommendations, depending on the interests of the moment.

*An economic policy can only be a trickle-down economy if it is designed to improve the standard of living of all individuals in the long run. A nation cannot prosper for long when it favors only the haves.

*The definition of “monetary and banking policies, in particular through the conduct of monetary policy which reconciles growth and inflation objectives in a more balanced manner within the framework of a dual mandate” … makes it an approximate discourse. There can be no inclusive growth, social justice and even less inclusion and resilience without a complete overhaul of the way of conceiving society, of conceiving Man, of conceiving the economy.

We have already been given the opportunity, in 2005, to take an introspective break, embodied by the fiftieth anniversary report, which has (in principle) made it possible to evaluate the achievements, identify the dysfunctions and define the aspirations since the beginnings of independence. In 2014, we engaged in a new exercise in introspection, in an examination of conscience (speech from the throne in 2014). This encourages us to be more vigilant so that in 2030, we do not have to repeat the same break because of pandemic poverty.

The question of the inclusion of new objectives, in particular relating to inequalities, in the mandate of central banks must be prescribed. Serious reflection must be undertaken to engage the trickle-down effect economy.

References:

- Antoine, P. (1970). Morale sans anthropologie. Editions de l’Epi,99-110.

- Artus, P. (2021). Il n’y a plus de théorie derrière le choix de politique monétaire. Chronique du cercle des économistes Boursorama.com.

– Beveridge, W., H. (1944).Full Employment in a Free Society. A report. London, Allen and Unwin.

- Blanchard, O., J. & Leigh, D. (2013). Growth Forecast Errors and Fiscal Multipliers. American Economic Review, vol. 103, No. 3, 117-120, May.

- Bourdieu, P. (1998). Contre-feux : propos pour servir à la résistance contre l’invasion néo-libérale. Éditions Liber.

- Brasseul, J. &Lavrard-Meyer, C. (2016). Économie du développement: les enjeux d’un développement à visage humain. Armand Colin.

- Cartapanis, A. (2021). Politique monétaire et inégalités : les banques centrales au four et au moulin ?. Chronique du Cercle des économistes Boursorama.com.

- Chauffour, J-P. (2018). Morocco 2040 Emerging by Investing in Intangible Capital. World Bank Group.

- Clerc, D(2005/6). Les trois modèles de développement. Alternatives économiques, N° 237, 56-57.

- Colletis, G. (2013/4). Pour un nouveau modèle de développement centré sur l’essor des activités productives.Géo-économie.

– Ecalle, F. (2019).Pourquoi le déficit public doit-il être inférieur à 3% du PIB ?.Capital.

- https://www.capital.fr/economie-politique/pourquoi-le-deficit-public-doit-il-etre-inferieur-a-3-du-pib-1336384

- EL Ghouari, T. (2018). Employabilité : les leviers à actionner d’urgence. Edition N°: 5372. 16 Octobre. L’Economiste.

- https://www.leconomiste.com/article/1035132-employabilite-les-leviers-actionner-d-urgence?page=3

- Filho, A-S & Johnston, D. (2005). Neoliberalism, a critical reader. Pluto Press.

- Friedman, M. (1962).Capitalism and freedom.University of Chicago Press.

- Harvey, D. (2005). A brief history of neoliberalism. Oxford University Press.

- Hayek, F. (1944). La Route de la servitude.Réédition PUF 2002.

- Krugman, P. (2010). Myths of Austerity.The New York Times, 1st of July, https://lc.cx/APbF.

- Malouche,M. &Partow,Z. (2019). Creating Markets in Morocco a Second Generation of Reforms: Boosting Private Sector Growth, Job Creation, and Skills Upgrading.Country PrivateSector Diagnostic. World Bank Group.

- Pébereau,M. (2006).La France face à sa dette.Rapport de la commission Pébereau ; Robert Laffont.

- Pennell R., C. (2000). Morocco since 1830: a history. New York Universty Press.

- Pommiers, E. (2018). Pourquoi doit-on garder un déficit public inférieur à 3 % du PIB ?.Le Monde.

- https://www.lemonde.fr/les-decodeurs/article/2017/04/18/pourquoi-doit-on-garder-un-deficit-public-inferieur-a-3-du-pib_5113056_4355770.html

- Rosanvallon,P. (1981). La crise de l’État-providence.

- Séroussi, R. (2012). La remise en cause du modèle actuel de développement.

- Ver Eecke, W. (1982). Ethics in economics: from classical economics to néo-liberalism. Philosophy and social criticism N° 9.

- Von Mises, L. (1947). Le Chaos du planisme. éd. Génin, 1956.

- Wittmann, W. (2007). Le prochain krach aura certainement lieu.Edition Orell Fuessli Verlag.

- Wresinski, J. (1987). Grande pauvreté et précarité économique et sociale. Report presented on behalf of the Economic and Social Council.

- Bank Al-Maghrib (2016). Stabilité financière : définitions, fondements théoriques et politique macro prudentiell. Rouiessi.

- Economic, Social and Environmental Council (2019). Les corps intermédiaires vont des syndicats aux associations et incluent également des institutions. Annual Report.

- High Commission for Planning (2021). “Revenus des ménages. Niveaux, sources et distribution sociale.Survey carried out from December 1, 2019 to the end of March 2020.

- High Commission for Planning, The United Nations system in Morocco and the World Bank (2020). Note stratégique : impact social et économique de la crise du covid-19 au Maroc. https://reurl.cc/A8qKG3.

- National Observatory on Human Development (2021). The Dynamics of Poverty in Morocco”, webinar, on June 08.

- Organization for Economic Co-operation and Development (OECD) (2018).Examen multidimensionnel du Maroc.

- Special Commission on the Development Model (Avril 2021). Le nouveau modèle de développement : libérer les énergies et restaurer la confiance pour accélérer la marche vers le progrès et la prospérité pour tous. General report.

- United Nations Development Program (UNDP) (2019). Au-delà des revenus, des moyennes et du temps présent : les inégalités de développement humain au XXIe siècle.Human Development Report.

- World Bank (2020). Morocco’s Economic Update. October.

- World Bank Group (2018). Kingdom of Morocco, governing towards efficiency, equity, education and endurance, a systematic country diagnostic.

- World Bank (2017). Le Maroc à 2040 : investir dans le capital immatériel pour accélérer l’émergence économique.

- Royal speech on the occasion of the 18th anniversary of the accession to the throne.

- Royal Speech, Feast of the Throne,

- Royal Message to participants in the 2nd «World Policy Conference » (2009).