Researcher/ Shurooq Abbas Merza

the college Computer science and information technology

Specialization Economics/ University of Wasit

smerza@uowasit.edu.iq

009647725029770

Summary

The study tried to reveal the foreign currency display window and the policy followed by the Central Bank of Iraq and what is the exchange rate policy in Iraq and what are the influences in trying to maintain the local currency (the Iraqi dinar) that dominates the foreign currency, as the standard method was used to clarify the effect of the window on the exchange rate The purpose of this is to show whether the currency window has a direct effect on the exchange rate of the dinar, or does it have a weak effect, as it is clear through the model used that the special window for currency exchange has a direct impact on the exchange rate of the Iraqi dinar by 98%

أثر نافذة عرض العملة الاجنبية على التغيرات في سعر الصرف

للدينار العراقي للمدة ( 2007 – 2017 )

كلية علوم الحاسوب وتكنولوجيا المعلومات / علم الاقتصاد

الملخص:-

حاولت الدراسة الكشف عن إليه نافذة عرض العملة الاجنبية وسياسه المتبعه من قبل البنك المركزي العراقي وماهي سياسه سعر الصرف في العراق وماهي مؤثرات في محاوله الحفاظ على العمله المحليه(الدينار العراقي) المسيطر على العمله الأجنبية إذ تم استخدام الأسلوب القياسي في توضيح إثر النافذة على سعر الصرف والغرض من ذلك هو بيان هل لنافذة العمله تأثير مباشر على سعر الصرف الدينار ام لها أثر ضعيف حيث يتبين من خلال النموذج المستخدم أن النافذة الخاصه لصرف العمله إثر مباشر على سعر الصرف للدينار العراقي بنسبه 98%

Introduction

Considering the importance of the issue of foreign currency and the exchange window by the Central Bank and the Iraqi ministries in order to grant the mechanism of action and control over the sale, purchase and maintenance of the exchange market and the national currency, and what is the harmonious policy in Iraq to preserve that currency. Where the study consists of three axes, the first axis includes the theoretical aspect regarding the foreign currency offer window and the policies of the Central Bank. exchange rate

On the second axis of the exchange rate, its concepts and policy used in Iraq and the third axis in which the practical side was used through the use of the standard method to clarify the effect of the currency display window changes in the exchange rate for a period (2007-2017). On Changes in the Iraqi Dinar Exchange Rate (2007-2017)

research importance

The importance of research speaks through the effective role of its monetary policy in drawing trends that lead to monetary stability and achieving balance, and what tools have been used to control the exchange rate and the mechanism that you apply and implement through the foreign currency display window through which balance and control of the exchange rate of the Iraqi Dinar are achieved.

Research problem

Despite the policy followed by the Central Bank of Iraq in controlling the foreign currency display window and interfering in the exchange market with the aim of obtaining a balanced exchange rate and raising the value of the Iraqi dinar, it has more negatively represented in Iraq’s reliance heavily on oil revenues that have decreased due to low oil prices. In turn, it led to a decrease in dollar revenues from oil and thus a decrease in foreign reserves at the central bank

Research hypothesis

The research stems from the hypothesis that the foreign currency display window, which is one of the indirect monetary policy tools followed by the Central Bank of Iraq, has a direct impact on changing and stabilizing the exchange rate of the Iraqi dinar.

Research objective: – The research aims to spend on a group of phenomena, namely

1_Learn about the foreign currency display window

2_Learn about the policies followed by the Central Bank of Iraq

3_Learn about the exchange rate policies in Iraq

4_Using the descriptive aspect of the window’s effect on the exchange rate of the Iraqi dinar for the period (2007-2017)

The first axis:-

First: – The concept of the foreign currency window

We know the base currency window as one of the methods and direct tools used by emerging economies of medium or financial depth to intervene in the exchange market for the purpose of the maintaining stability of exchange rates and the general level of prices under the policy of targeting inflation ..

In order to use the currency window in profitable economies that suffer from the backwardness of their financial and monetary systems, the disruption of their sectoral economic structure and their heavy reliance on to cover domestic demand ,, where the currency auction is used as one of the monetary policy methods to influence the exchange rate and to ensure monetary stability[1] thus the central bank is It is the effort that it controls from the foreign currency in the entire exchange market, meaning that the central bank does not limit its role Within the concept of intervention to create balance, and that it does not control the demand side of the foreign currency as its source is the private sector and it cannot control the supply side because its source is international reserves (Government and petroleum dollar imports) [2]

Therefore, Akim at the window can through what the Ministry of Finance needs for more than (80%) of its dollar revenues for the dinar currency to tighten public expenditures for the public budget. Therefore, it sells most of the dollars of oil to the Central Bank of Iraq to obtain the dinar. As for the central bank, it is exchanging The dollar that he obtains from the Ministry of Finance in dinars by selling dollars in the market to create a balance in the money supply and then control inflation and exchange rates[3]

Second: The objectives of the foreign currency display window

The work in this window was made for an investigation

1_It is a means for indirect administrations to implement monetary policy, with the aim of controlling liquidity, achieving balance in the money supply and providing appropriate financial investment opportunities.

2_It is a direct intervention tool aimed at achieving stability in the value of the Iraqi dinar through the parallel exchange rate with the aim of stabilizing the general level of prices and monetary stability …

… It is a direct intervention tool aimed at achieving stability in the value of the Iraqi dinar through the parallel exchange rate with the aim of stabilizing the general level of prices and monetary stability

_ 3_The window enables the unification of the exchange rates of the Iraqi dinar by saturating the Iraqi market with foreign currency, after the exchange rates were up to (11) the exchange rate a year ago (2003) …

_ 4_Its contribution to raising the purchasing power of people with limited incomes by improving the value of the Iraqi dinar, which in turn is reflected in the real value of income.

5_ Its ability to provide foreign currency reserves that exceeded what was allocated by the International Monetary Fund, in order to achieve monetary stability and build foreign currency reserves to cover imports[4]. …

Third: Reforming the foreign currency supply by the policies followed by the Central Bank of Iraq in reforming the currency display window

The Iraqi Terminal Bank produced after 2003 a new monetary policy to improve the exchange rate of the dinar and get rid of the fluctuations it suffers from by creating a window for displaying foreign currency for sale and purchase, which in turn contributes to raising the value of the Iraqi dinar, and this in turn contributes to achieving monetary and economic stability and improving purchasing power. And that the dinar is a store of value instead of the dollar .. However, the conditions that Iraq faced from 2014 onwards, which were based on low oil prices, which is the main source for providing dollars, which was the reason for the decline in Iraq’s imports in that currency, which reduced the quantity purchased. In the Ministry of Finance by the Central Bank, in addition to the bank’s taking a set of decisions that would deprive many companies from participating in the window based on the penalties applied by the bank for violating instructions .. Failure to enter companies into the window of buying and selling foreign currency to buy dollars leads to a lack of offer The dollar was restricted to a greater extent to cover import operations, as it created a parallel market for the exchange rate, which increased by (80) dinars over the official exchange rate for the year 2015))[5]

As well as a course in eliminating economic inflation, ensuring economic stability and stabilizing the currency exchange rate for the purpose of keeping cash as a measure of value and a means of exchange, as well as setting up the renewal of interest rates on savings and the rest of banking services, supervising private banks, managing foreign currency auctions, issuing the Iraqi dinar, and managing financial reserves that were reflected by the state. And the development and implementation of financial laws[6] 1)).

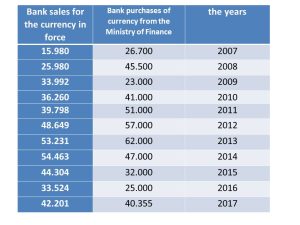

Table 1) shows the window for displaying foreign currency by the Central Bank of Iraq for the period 2007-2017)) …

** As it is noticed from the table .. Column (1) the increase in the Central Bank’s purchases of dollars in the Ministry of Finance, as it reached (26.700) million dollars in 2007 and after that it started to rise, reaching its highest levels in 2013, which amounted to 62,000 dollars in purchases A million dollars and then proceeded to decline after that, reaching its lowest level by (25.653) million dollars in 2016, and in 2017 it rose to (40.355) million dollars. The reason for this rise and decrease is due to the instability of oil revenues resulting from the fluctuation in oil prices as well as Weak non-oil export sectors …

** As for the second column (2) in the table, it represents the sales of the Central Bank of Iraq to the Ministry of Finance through the window, where it was produced during the period (2007-2014) as it reached (15.980) ) million dollars and continued to rise steadily at the seizure ((54.463) in 2014, but This level is higher than it is in the levels of the rise in the currency purchase window, and then those sales of the currency took off, down to (42.201) million dollars in 2017, and that is through the interference of the Central Bank of Iraq in reducing its sales of the currency in order to preserve the value of the local currency and an increase in the bank’s cash reserves[7].

** Purchases and sales of the Central Bank of Iraq of foreign currency through the window (in million dollars)

** Source: The Central Bank of Iraq, the bank’s annual bulletin (2002-2012), Department of Statistics and Research

second axis // The theoretical and analytical side of the exchange rate in Iraq

For (2007-2017)

First: – The concept of the exchange rate

:: The exchange rate means that it is the number of units of the currency that are exchanged for one unit of the foreign currency in the relationship trading market, or it is the value of the foreign currency divided by units of the local currency ..[8] (1)

As it aims to resist imported inflation and improve the level of competitiveness of enterprises, if the reduction in import costs leads to a decrease in the level of imported inflation. It also aims to allocate resources so that a large number of goods can be exported, in addition to that it plays an important role in the distribution of income among the local sectors .. When the competitiveness of the export sector increases as a result of the Decrease in the real exchange rate, this makes it more profitable as the profit returns to the owners of capital while the purchasing power of workers decreases and vice versa when the exchange rate decreases ,,, It also plays a role in the development of local industries so that the central bank can reduce the price Spending to encourage) [9].

National industries, and the devaluation of the currency by the central bank protects the local market from foreign competition and encourages exports

Second … the factors affecting the exchange rate

[10] The exchange rate is affected by several factors, including:

1_Inflation: – The independent monetary policy cannot coexist with the exchange rate stabilization system, and this is called the impossibility of the Holy Trinity, as the link between treating inflation and exchange rates has led some economists to say that one of the costs of dealing with inflation is the increase of exchange rate fluctuations. Inflation and growth affect the increase in exchange rate fluctuations

. 2_The effect of money supply on exchange rates, as the classic sees through the quantitative theory of money that there is a relationship between the quantity of money and the general level of prices moving in the same ratio and the same direction.

3_The effect of interest rates on the exchange rate through the movement of international capital, as the country in which the real interest rates rise, this encourages capital to move the hand, which means an increase in the supply of foreign currency at home, and thus the deterioration of its exchange rate …

4_The effect of the balance of payments on the exchange rates, since when a deficit occurs in the balance of payments, this leads to an increase in its demand for foreign currencies for that deficit, and in return for a decrease in the demand of foreigners for the local currency means a deterioration of the exchange rate for that country’s currency and vice versa when a surplus occurs in the balance of payments …

5_The role of the general budget to influence the exchange rate, so if the state follows a policy whenever it is constructed to reduce the size of government spending, this leads to a reduction in the volume of demand, a decrease in the level of economic activity and a decrease in the rates of inflation, which leads to an increase in the exchange rate of the foreign currency[11]

Third: – The theoretical and analytical direction of the exchange rate policies in Iraq for the period

(2007-2017)

After the Central Bank of Iraq gained its independence after events a year later

(2003)

He drew his monetary policy according to Law No. 56 of 2004, which stipulated the restructuring of the Iraqi economy and the orientation towards a market economy in order to improve and stabilize the value of the Iraqi dinar, where it governs the exchange rate and intervenes in the market through the foreign currency display window where the exchange rate is determined. Through the mechanism of supply and demand[12] (1) on the foreign currency in Iraq .. The Central Bank satisfies the local trends of the dollar, thus achieving homogeneity in the mechanism of the exchange market throughout Iraq and thus the official exchange rate is the local price in the window, which represents the price of selling the dollar to banks and transfer companies, while the parallel price represents the market price, which is the price at which banks and companies follow the transfer of the dollar to traders and dealers, and it is based on the laws of supply and demand, as the bank tries to influence the market price and achieve the window’s goals, and it represents the difference between the window price and the price of

Market B (the exchange gap). If the foreign currency spent in the window is less than the demand for it, its price in the market increases, thus leading to an increase in the gap between the official rate and the parallel rate, thus negatively affecting the value of the Iraqi dinar and weakening confidence in it[13] (1) and that the exchange gap is its duty to get rid It expands depending on its influence by several factors, including [14]

1_The percentage of foreign currency sales coverage by the size of the total foreign currency demand (supply coverage to the demand)

2_The nature of sales in the window (cash // remittances // documentary credits). The increase in cash sales reduces the exchange gap due to the intensity of commercial dealings with a country banned from the banking system.

3_Instructions for the foreign currency display window and the interdependence of control procedures between government institutions related to the foreign currency display window and the use of official documents issued by these institutions are basic requirements by the Central Bank in order to meet the dollar Purchase requests from the window and count them as evidence of banks’ commitment to pay their tax obligations and Turkish discharges.

Table (2) indicates the gradual improvement of the Iraqi dinar exchange rate towards the US dollar in the official market for the period (2007-2017) … which is the fixed exchange system actually applied during this period by the Central Bank through the window …

If the fixed exchange system can lead to economic attacks, i.e. a currency crisis in the event that the value of the currency is valued higher than its real value, as well as finding the exchange rate equilibrium to the Iraqi dinar against the dollar leads to stability in exchange rates and this will be reflected positively on price stability and then increase The attractiveness of the local currency, in turn, works to stabilize foreign reserves, and this indicates that the fixed exchange system is associated with high fluctuations in foreign reserves in order to maintain the stability of exchange rates, on the contrary, in the known exchange system, which is associated with slow fluctuations in those reserves against high fluctuations in exchange rates [15](1)

… As the data of Table (2) show that there is a avoidance between the official and parallel market exchange rates, where the exchange rate is recorded

(1) … Muhammad Khairy Dawood // Measuring the problem of the impossible trinity in Iraq for the period 2004-2014 // Central Bank of Iraq // Volumetric Monetary and Financial Studies // Volume (1) The second issue // p. 66

The official value amounted to (1255) dinars / dollar in 2007, while that year a value of (1267) dinars / dollar was recorded in the parallel market, and this discrepancy between the two markets remained during the period studied, then the official exchange rate took a downward path to reach (1166) 1170, 1193) during the period (2008-2014) respectively, then it increased by a small amount in 2015 to become the value of (1167) dinars / dollar .. This improvement in exchange rates came as a result of the increase in the volume of imports of foreign currency

Careful about the rise in oil prices, and then it witnessed a rise in the years (2016-2017) by (1190), which is a slight increase from what it was before in 2008 and by a fixed amount during the two years, and There were no gaps in it from the official and parallel exchange rate[16], and the reason for that stability is due. In the exchange rate of the local currency to the standards set by the Central Bank through the entry of banks and companies into the window of sale and purchase of foreign currency, with the aim of controlling the sale of the dollar on the one hand and maintaining the exchange rate on the other hand … and combating money laundering, which led to the building of units And organizational and technical capabilities to determine their systems and internal control[17] (1) as well as the exchange system

(1) Ali Mohsen Ismail // Monetary Policy Challenges and Ways to Confront them // Central Bank of Iraq // 2017 // p. 15

The constant makes them maintain cash reserves to avoid the fluctuations that occur in the supply and demand for foreign currencies, as whenever the size of the reserve was large, which helped to strengthen the position of the local currency, or if the size of the reserve was insufficient .. This leads to a devaluation of the local currency and then it becomes The exchange rate of the local currency is inconsistent with the reality, which results in the flight of local capital, so that the volume of reserves, if they are large at the central bank, will make the country ready to face the shocks to the balance of payments and also help in adopting a fixed exchange system[18] (1)

Table (2) * The exchange rate of the Iraqi dinar against the US dollar in the official and parallel market

| the years | The official exchange rate for the dollar | The parallel exchange rate to the dollar |

| 2007 | 1255 | 1267 |

| 2008 | 1193 | 1203 |

| 2009 | 1170 | 1182 |

| 2010 | 1170 | 1186 |

| 2011 | 1170 | 1196 |

| 2012 | 1166 | 1233 |

| 2013 | 1166 | 1232 |

| 2014 | 1166 | 1214 |

| 2015 | 1167 | 1247 |

| 2016 | 1190 | 1275 |

| 2017 | 1190 | 1258 |

third axisThe practical aspect:-

The foreign currency display window is considered a way to know the extent of its impact on the changes in the exchange rate of the Iraqi dinar, as it was used to know and measure real data to know and measure this effect, as the program (SPSS) V.21) was used to know the results and analyze them and use the simple linear regression model to know the significance of the effect. Therefore, it is necessary to put the hypothesis that:

:There is an effect of the foreign currency display window on the changes in the exchange rate of the Iraqi dinar at the level of

Significant (0.05).

: There is no effect of the foreign currency display window on the changes in the exchange rate of the Iraqi dinar at the level of

Significant (0.05).

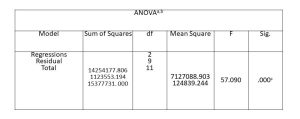

As the foreign currency window included the variables (purchases and sales). As for the exchange rate, it is represented by the official exchange rate and the parallel exchange rate. After measuring the impact of purchases and sales as independent variables on the official exchange rate as the dependent variable and choosing the best model for the data, it is found that the value of (0.927 =), which is It means (the coefficient for determining the best model), meaning that the independent variables interpreted (92%) affect the dependent variable (the official exchange rate), meaning that the remainder is considered random errors (unknown errors) as its value reached (8%) and as shown in the table below:

Table (No.) shows the criteria for the best regression model

| Model | R | R Squareb | Adjusted R Square | Std. Error of the Estimate | Change Statistics | ||||

| R Square Change | F Change | df1 | df2 | Sig. F Change | |||||

| 1 | .963a | .927 | .911 | 353.32597 | .927 | 57.090 | 2 | 9 | .000 |

| a. Predictors : Sales, purchases |

| b. For regression through the origin (the no-intercept model), R Square measures the proportion of the variability in the dependent variable about the origin explained by regression. This CANNOT be compared to R Square for models which include an intercept. |

| c. Dependent Variable: The official exchange rate |

| d. Linear Regression through the Origin |

As the hypothesis of the study was developed, which states:

H : There is an effect of purchases and sales on changes in the official exchange rate at a significant level (0.05).

H : There is no effect of purchases and sales on changes in the official exchange rate at a significant level (0.05).

The table below studies the suitability of the data regression line and its null hypothesis, as the value of (57.090 F = calculated) at the level of significance (0.000) and it is less than (0.05), which indicates that there are no significant Differences and that the model represents the studied phenomenon is heavy and accurate and that the regression line fits the given data Any acceptance of the null hypothesis. As shown below:

Table No. () shows the analysis of variance table

|

a. Dependent Variable: Official exchange rate |

|

b. Linear Regression through the Origin |

|

c. Predictors: Sales, purchases |

|

d. This total sum of squares is not corrected for the constant because the constant is zero for regression through the origin. |

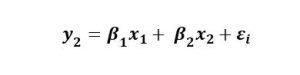

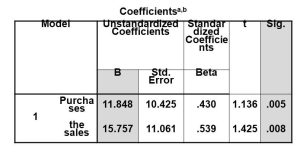

After measuring the effect of the independent variables (purchases and sales) on the official exchange rate, it was found that they affect a significant level less than (0.05), as the effect of purchases reached (11.848), meaning that the official exchange rate changes by (11.848) per unit. As for sales, the amount of its impact is (15.757) meaning that the official exchange rate changes by (15.757) per unit. Then the equation of the regression line becomes

As follows

Official exchange rate =) 11.848 (purchases + (15.757) sales +

|

a. Dependent Variable: Official exchange rate |

|

b. Linear Regression through the Origin |

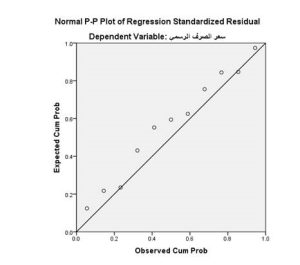

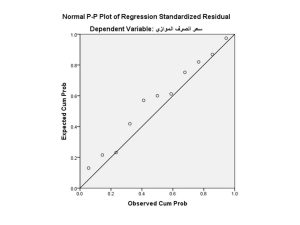

It is also possible to know the modularity of the normal distribution of random errors of the specified model, as shown in the figure below

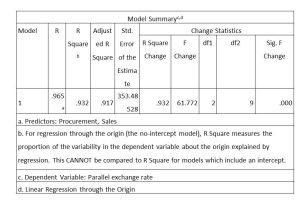

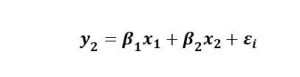

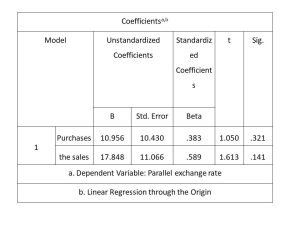

The measurement of the effect of purchases and sales as independent variables on the official exchange rate is considered as the dependent variable. We move to measure the effect of independent variables on the parallel exchange rate and choose the best model for the data. 93%) affect the dependent variable (the parallel exchange rate), meaning that the remainder is considered random errors (unknown errors) as its value reached (7%) and as shown in the table below:

Table (No.) shows the criteria for the best regression model

As the hypothesis of the study was developed, which states:

: HThere is an effect of purchases and sales on changes in the parallel

exchange rate at a significant level (0.05).

: H There is no effect of purchases and sales on changes in the parallel exchange

rate at a significant level (0.05).

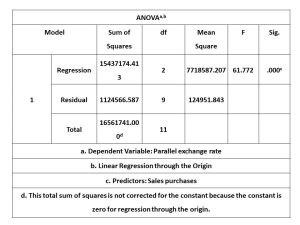

The table below studies the suitability of the data regression line and its null hypothesis, as the value of (61.772F = calculated) at the level of significance is (0.000) and it is less than (0.05), which indicates that there are no significant differences and that the model represents the studied phenomenon is heavy and accurate and that the regression line fits with the given data Any acceptance of the null hypothesis. As shown below:

Table No. () shows the analysis of variance table

After the exchange rates and local sales start on the exchange rates and sales) on the exchange rates, sometimes, different prices from their prices (0.05), other differences, the exchange rates (10.956) per unit As for the occasions, their effect on the change (10.956) (17.848) In other words, the parallel exchange rate changes (17.848) per unit at that time

The equation for the regression line becomes as follows:

Parallel exchange rate =) 10.956 (purchases + (17.848) sales +

It is also possible to know the modularity of the normal distribution of random errors of the specified model, as shown in the figure below

Conclusions

1_The Central Bank of Iraq is the one that regulates, monitors, and moves cash inflows and outflows from Iraq that help maintain a stable and stable exchange system.

2_The bank has large cash reserves through the stability of the exchange rate which helps preserve the value of the local currency and the stability of its exchange rate

3_There is a direct relationship between oil prices and the exchange rate of the Iraqi dinar, that is, whenever oil prices increase, it causes a rise in the exchange rate and vice versa.

4_The central bank controls the levels of the exchange rate through auctions for the sale and purchase of foreign currency

Recommendations

1_The necessity to respect Article (2) of the Central Bank Law No. (56) of 2004, which grants the Central Bank its independence and not to interfere with the executive and law authorities in Parliament in its powers.

2_Working to increase the production capacity of the national economy to meet the needs of the local market and focus on non-oil industrial projects, which leads to a decrease in the demand for the dollar and an increase in the demand for the local currency

3_The need to coordinate work between the Central Bank of Iraq and the supervisory authorities to prevent smuggling of dollars out of Iraq

4_Coordination between fiscal and monetary policy and the need for the central bank to intervene in the process of preparing the state’s general budget in order to reduce pressure on the bank’s reserves in the face of monetary financial challenges

Sources

1 shaker Jamoud Salal, Hassan Khalaf Radi // Analysis of the effect of the foreign currency sale window on inflation rates in Iraq // Al-Maamoun College Magazine // Issue thirty-eighth // 2019 // p. 170 …

2 Ali Mohsen Ismail // Monetary Policy in the Face of Challenges (2015-2016) // Central Bank of Iraq // 2017 // p. 7

3 Ali Mohsen Ismail // Monetary Policy in Face of Challenges // Iraqi Central Bank // 2017 // pp. 7-8

4 Ahmad Subaih Attiyah // Rabab Nazim // Currency Auction between the abundance of monetary materials and the stability of the exchange rate // Al Kut University College Magazine // First Issue // 2016 // pg

5 Najla Shimon Shlimon // Analysis of determining factors, trends, the exchange rate of the Iraqi dinar against the US dollar for the period 2014-2015

6 Department of Statistics and Research // p. 14

[1] Falah Hassan Muhammad // The role of the financial control system in preventing the phenomenon of foreign

currency smuggling / Journal of Integrity and Transparency for Research and Studies // Sixth Edition, p. 124

7 Interpretation of the table from the researcher’s analysis

8 Shimon Slimoun magazine // Analysis of the determining factors of trends in the exchange rate of the Iraqi dinar against the US dollar for the period (2004-2015) // Previous source, p. 3

9 exchange rate against the US dollar using Markov chains for a period (2008-2011)

The Central Bank of Iraq // General Directorate of Statistics and Research // Financial Market Research, p. 1-5

National industries, and the devaluation of the currency by the central bank protects the local market from foreign competition and encourages exports

10 Sabah Nuri Abbas // The effect of inflation on the equilibrium exchange rate of the Iraqi dinar for the period

Baghdad College of Economic Sciences University // Seventeenth Edition // 2008 2005_1990)pp. 66-64

11 Sabah Nuri Abbas // The effect of inflation on the equilibrium exchange rate of the Iraqi dinar for the period

Baghdad College of Economic Sciences University // Seventeenth Edition // 2008 2005_1990)pp. 66-64

12 Hussein Atwan // The exchange rate of the Iraqi dinar between the fluctuation of global oil prices and the pressure on international reserves // The Central Bank of Iraq, Journal of Monetary Policy Research, Issue 1 // 2016, p. 100

13 Mahmoud Muhammad Mahmoudani ,, Bilal Qasim Muhammad /// The effect of the currency sale window on changes in the exchange rate in Iraq for the period (2004-2015) // Journal of Economic and Administrative Sciences // Issue 99 // The magazine 23 // 2017 / / P. // p. 306

14 Hussein Atwan Mahous // Reducing the gap of the dinar exchange rate in the official and parallel market in the past and present – the stability of the largest sales of the lowest // Iraqi Economists Network // 2018 // p 2

15 Muhammad Khairy Dawood // Measuring the problem of the impossible trinity in Iraq for the period 2004-2014 // Central Bank of Iraq // Volumetric Monetary and Financial Studies // Volume (1) The second issue // p. 66

16 Interpretation of Table (2) from the researcher’s analysis

17 Ali Mohsen Ismail // Monetary Policy Challenges and Ways to Confront them // Central Bank of Iraq // 2017 // p. 15

18 Hanan Abdul-Khader and others // an evaluation study of the foreign exchange rate policy in Iraq // Iraqi Journal of Administrative Sciences // Issue Twenty //

[1] shaker Jamoud Salal, Hassan Khalaf Radi // Analysis of the effect of the foreign currency sale window on inflation rates in Iraq // Al-Maamoun College Magazine // Issue thirty-eighth // 2019 // p. 170 …

[2] Ali Mohsen Ismail // Monetary Policy in the Face of Challenges (2015-2016) // Central Bank of Iraq // 2017 // p. 7

[3] Ali Mohsen Ismail // Monetary Policy in Face of Challenges // Iraqi Central Bank // 2017 // pp. 7-8

[4] Ahmad Subaih Attiyah // Rabab Nazim // Currency Auction between the abundance of monetary materials and the stability of the exchange rate // Al Kut University College Magazine // First Issue // 2016 // pg

[5] Najla Shimon Shlimon // Analysis of determining factors, trends, the exchange rate of the Iraqi dinar against the US dollar for the period 2014-2015

Department of Statistics and Research // p. 14…

[6] Falah Hassan Muhammad // The role of the financial control system in preventing the phenomenon of foreign

currency smuggling / Journal of Integrity and Transparency for Research and Studies // Sixth Edition, p. 124

[7] Interpretation of the table from the researcher’s analysis

[8] ) Shimon Slimoun magazine // Analysis of the determining factors of trends in the exchange rate of the Iraqi dinar against the US dollar for the period (2004-2015) // Previous source, p. 3

[9] ) exchange rate against the US dollar using Markov chains for a period (2008-2011)

The Central Bank of Iraq // General Directorate of Statistics and Research // Financial Market Research, p. 1-5

National industries, and the devaluation of the currency by the central bank protects the local market from foreign competition and encourages exports

[10] Sabah Nuri Abbas // The effect of inflation on the equilibrium exchange rate of the Iraqi dinar for the period

Baghdad College of Economic Sciences University // Seventeenth Edition // 2008 2005_1990)pp. 66-64

[11] Sabah Nuri Abbas // The effect of inflation on the equilibrium exchange rate of the Iraqi dinar for the period

Baghdad College of Economic Sciences University // Seventeenth Edition // 2008 2005_1990)pp. 66-64

(same source as previous)

[12]Hussein Atwan // The exchange rate of the Iraqi dinar between the fluctuation of global oil prices and the pressure on international reserves // The Central Bank of Iraq, Journal of Monetary Policy Research, Issue 1 // 2016, p. 100

[13] [1] Mahmoud Muhammad Mahmoudani ,, Bilal Qasim Muhammad /// The effect of the currency sale window on changes in the exchange rate in Iraq for the period (2004-2015) // Journal of Economic and Administrative Sciences // Issue 99 // The magazine 23 // 2017 / / P. // p. 306

[14] Hussein Atwan Mahous // Reducing the gap of the dinar exchange rate in the official and parallel market in the past and present – the stability of the largest sales of the lowest // Iraqi Economists Network // 2018 // p 2

[15] Muhammad Khairy Dawood // Measuring the problem of the impossible trinity in Iraq for the period 2004-2014 // Central Bank of Iraq // Volumetric Monetary and Financial Studies // Volume (1) The second issue // p. 66

[16] Interpretation of Table (2) from the researcher’s analysis

[17] Ali Mohsen Ismail // Monetary Policy Challenges and Ways to Confront them // Central Bank of Iraq // 2017 // p. 15

[18] 1 Hanan Abdul-Khader and others // an evaluation study of the foreign exchange rate policy in Iraq // Iraqi Journal of Administrative Sciences // Issue Twenty // p. 77