Shaymaa Abdulahdi Hussein

University of Babylon – College of Administration and Economics

bus.shaimaa.abd@uobabylon.edu.iq

009647706316163

Mustafa Kamil Shakeer

University of Babylon – College of Administration and Economics

bsc.mostafa.kamel@uobabylon.edu.iq

009647706025901

Ruslan Abdul- Zahra Safi

University of Babylon – College of Administration and Economics

bsc.raslan.abdelzahra@uobabylon.edu.iq

009647832560400

Abstract

The Egyptian Stock Market is one of the emerging financial markets that has achieved relative success with developments. The financial market conditions reflect the economic situation of the Arab Republic of Egypt. The financial stability witnessed in the Egyptian financial markets serves as a gauge of the role of the Central Bank of Egypt. Therefore, the research focuses on the key independent indicators of the Central Bank of Egypt, represented by (assets, credit, and deposits), and the impact of Egyptian financial market indicators represented by (trading volume, nominal value, and number of companies). Through these indicators, a relationship of mutual influence between the economic indicators of the Central Bank of Egypt and the financial markets was established, proving the research hypothesis.

Keywords: Central Banks, Stock Market, Assets Index, Credit Index, Deposit Index

قياس وتحليل دور البنوك المركزية في تنشيط الاسواق المالية للمدة

(2004-2020) (مصر انموذج )

م.د. شيماءعبد الهادي حسين

م.م. مصطفى كامل شكير

م.د. رسلان عبد الزهرة صافي

جامعة بابل- كلية الادارة و الاقتصاد

المستخلص

يعد سوق مصر للأوراق المالية من الأسواق المالية الناشئة التي حققت نجاحاً ذات تطورات نسبية اذ ان أوضاع الأسواق المالية هي مرآة تعكس الوضع الاقتصادي لجمهورية مصر العربية وان الاستقرار المالي الذي شهدته الأسواق المالية المصرية هو مقياس لدور البنك المركزي المصري، لذلك فقد ركز البحث على اهم المؤشرات المستقلة للبنك المركزي المصري والمتمثلة ب(الموجودات، الائتمان، الودائع) وتأثير مؤشرات الأسواق المالية المصرية المتمثلة ب( حجم التداول، القيمة الاسمية، عدد الشركات) والتي من خلالها تم الوصول الى علاقة ذات تأثير متبادل بين المؤشرات الاقتصادية للبنك المركزي المصري والأسواق المالية واثبات فرضية البحث.

الكلمات المفتاحية: البنوك المركزية, سوق الاوراق المالية, مؤشر الموجودات, مؤشر الائتمان, مؤشر الودائع

Introduction:

Financial markets play a significant role in stimulating the economy of any country by mobilizing idle funds and directing them towards productive economic sectors (agricultural, industrial, tourism, etc.). To activate the role of financial markets in any country, there must be a specific entity that manages these markets, provides the necessary data and information to investors in these markets, and also offers the essential indicators to measure the performance of these markets. One of the key factors that enhance the effectiveness of these financial markets is the entry of foreign investors into these markets through their acquisition of stocks and bonds of companies operating in the financial markets. This expansion increases the size of these markets, boosts their financial transactions, and diversifies their offerings. Additionally, financial markets have impacts on the fiscal and monetary policies of countries, including contributing to financial stability, achieving economic growth, and maintaining economic balance.

- 1. Research Importance:

The importance of research is highlighted through understanding and measuring the Central Bank’s indicators on financial market indicators over the period (2004-2020).

- 2. Research Problem:

The research problem is highlighted by posing the following questions:

A- Is there an impact of the Central Bank’s indicators on financial market indicators in Egypt?

B- What is the nature of this impact (positive, negative)?

C- What is the degree of the impact (strong, weak)?

Research Hypothesis:

The research starts from a hypothesis stating: There is a direct and proportional impact of the Central Bank indicators on the financial markets’ indicators in Egypt during the period (2004-2020).

Research Objectives:

This research aims to:

A- Identifying the performance measurement indicators of the Central Bank in Egypt.

B- Recognizing the measurement indicators of the financial markets in Egypt.

C- Determining the extent of the Central Bank indicators’ impact on the financial markets’ indicators in Egypt.

- 5. Research Methodology:

The research relies on a combination of theoretical (descriptive) and quantitative methods using the statistical software (EVIEWS9).

- 6. Temporal and Spatial Boundaries of the Research:

– Temporal Boundaries: The period (2004-2020).

– Spatial Boundaries: The Central Bank of Egypt and the Egyptian financial markets.

First Section: The Theoretical Framework of the Central Bank of Egypt

Firstly: The Central Bank of Egypt

The Central Bank of Egypt is the official central bank of the Arab Republic of Egypt, established in accordance with Law No. 250 of the year 1960. It currently operates under Law No. 194 of the year 2020 and its amendments as an independent entity and the official bank of the Egyptian state, reporting to the

President of the Republic. Its responsibilities include the following: (Al-Monoufi, 2021, p. 25)

- Issuing the local currency, the Egyptian Pound, in all its denominations.

- Formulating monetary policy, determining its tools that can be utilized, and implementing measures to maintain the stability of the Egyptian pound.

- Managing the state’s reserves of gold and foreign currencies.

- Supervising the Egyptian banks.

- Managing the Egyptian government’s debts.

Secondly: The Importance of the Central Bank

The Central Bank of Egypt is one of the state’s public institutions, responsible for issuing legal tender for the state. In addition to its core function of supervising and controlling the cash flow in the markets, the Central Bank of Egypt is the supreme authority overseeing monetary and credit affairs. This authority, held by the Central Bank of Egypt, aligns with the state’s economic objectives. Moreover, it plays a role in protecting banks from collapsing during crises, serving as a lender of last resort. Additionally, it performs a specific function as mandated by law, which involves formulating policies to assist in fulfilling its role in the markets, achieving monetary equilibrium, and economic stability. (Saad, 2013, p. 119)

Thirdly: the relationship between the Central Bank of Egypt and the financial markets

In the twentieth century, the role of government underwent a fundamental change in the economy. Government functions increased significantly, especially after breaking free from the constraints imposed by some classical concepts. This evolution in government tasks was not accompanied by a proportional increase in public revenues. Consequently, governments resorted to domestic and foreign borrowing, particularly those with advanced financial markets. Governments turned to borrowing from individuals, financial institutions, and central banks to finance the deficit between expenditures and revenues. This illustrates the close relationship between government deficit policy and financial markets. In the 20th century, the role of government underwent a fundamental change in the economy. The functions and power of this relationship increased, primarily through the availability of highly flexible financial markets to finance the private sector’s needs. As a result, fiscal authorities gained the ability to maneuver freely within the framework of fiscal policy and influence macroeconomic variables through the use of financial instruments provided by the financial markets. The financial markets are considered the optimal channel for implementing the monetary policy followed by the Central Bank of Egypt, through the issuance of various securities (bonds and stocks) with different maturities.

Fourthly: establishments affiliated with the Central Bank of Egypt

- Printing House of Money: The Egyptian Currency Printing House at the Central Bank of Egypt is one of the oldest currency printing facilities in Africa and the Middle East. Established in the 1960s, it commenced production in 1967, printing Egyptian banknotes within the Arab Republic of Egypt, relying on the trained technical staff for this new printing system at the time (offset printing and intaglio printing).

- Egyptian Banking Institute: The Egyptian Banking Institute was established in accordance with Law No. (78) of the year 1991 by the Central Bank to become its official training arm. Its primary mission is to refine the technical and managerial skills of employees in the financial and banking sector. Under the aforementioned law, the Institute is governed by a Board of Trustees, including the Governor of the Central Bank and the Institute’s Executive Director. In 2003, the Institute was redefined as an independent entity under Law No. (88) with an independent budget, and is governed by a Board of Directors chaired by the Governor of the Central Bank of Egypt. Since then, the Institute has witnessed growth and development in terms of the scale and diversity of its activities, training facilities, internal resources, and most importantly, its training services and products. (Sultan, , 2021, p. 35)

- The United Bank: The United Bank of Egypt, established in 2006, is one of Egypt’s banks. The bank was formed through the merger of three banks facing insolvency risks due to accumulated losses and non-performing debts: Nile Bank, United Bank of Egypt, and the International Islamic Bank for Investment and Development. The Central Bank owns around 99.9% of the United Bank’s shares. Initially intended as a temporary measure, the Central Bank’s ownership of United Bank was meant for supervisory, regulatory, and oversight purposes in the banking system, rather than being an active player in the Egyptian market. (Tantawi, 2020, p. 47)

- Egypt’s banks for technological advancement: Banque Misr for Technological Advancement is an Egyptian government-owned joint-stock company affiliated with the Central Bank of Egypt. Established in 199, in partnership and contribution from the Central Bank of Egypt and several banks operating in the Egyptian market, it operates in the field of national payment switch, electronic clearing, electronic payments, as well as designing information systems and programs for electronic payments within and outside Egypt. (El-Abirsh, 2022, p. 24)

Fifthly: the governing regulations of the Central Bank of Egypt

- Law No. 250 of 1960.

- Law No. 194 of 2020.

Section Two: Analysis of the Performance Indicators of the Stock Market of the Arab Republic of Egypt

Firstly: The emergence of the stock market in Egypt

The financial markets in Egypt are among the oldest in the Middle East, with the first Egyptian stock market established in Alexandria in 1883, and the largest stock market in Cairo in 1890. The government has declared a policy of economic openness, explicitly recognizing the importance of the private sector and leveraging its resources, including savings, and the existence of a securities market that aggregates private savings and provides the national economy with an investment market for all projects. (Al-Hassanawi, 2017, p. 201)

The state’s general ambitions increased (1997) to achieve its goals, and these goals include the following: (Al-Hassanawi, 2017, p. 201)

- 1. Working on enhancing and updating operational methodologies through technological advancements and the development of innovative financial tools and services.

- 2. The scope of work extends beyond local investors to encompass a more inclusive approach for working investors.

- Strengthening the role of banks and insurance regulatory authorities in securities to serve a larger number of investors.

Firstly: Central Bank Indicators in the Arab Republic of Egypt

The Central Bank of Egypt, in its capacity as the regulator of the banking sector (which dominates the financial system in Egypt), carries out its role with the assistance of the General Authority for Financial Supervision. They coordinate to ensure the safety and stability of the financial sector as a whole, even in the face of shocks (both internal and external) or when imbalances accumulate. Among the most important indicators in this regard are those we will address.

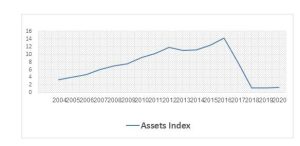

- Asset Indicator: The asset indicator represents one of the most important indicators of financial stability in the banking sector. It is also among the key assets in the Central Bank’s budget, comprising foreign currency assets, followed by gold and other rights (Al-Ali, 2020, p. 2). Observing Table (1), we note a continuous increase in assets since 2004 until 2012. This increase can be attributed to the two periods the financial system went through: the first from 2004 to 2008 and the second from 2009 to 2012. These periods represent efforts to enhance the efficiency and ensure the safety of the banking system, increase its competitiveness, and improve its risk management capabilities. The Central Bank conducted comprehensive financial and administrative restructuring and enhanced the management of all types of risks to achieve financial stability.) The Central Bank of Egypt, 2011–2012, pp. 28-29)

Table (1): Economic Indicators for Financial Stability in the Arab Republic of Egypt (Million Dollars)

| Year | Assets (Million Dollars) | Capital (Million Dollars) | Credit (Million Dollars) | Deposits (Million Dollars) | Reserves (Million Dollars) |

| 2004 | 3.284 | 102.266 | 1.849 | 77.768 | 48.143 |

| 2005 | 3.977 | 123.443 | 2.152 | 90.060 | 53.195 |

| 2006 | 4.731 | 132.907 | 2.286 | 99.274 | 56.551 |

| 2007 | 6.084 | 172.729 | 2.311 | 119.696 | 65.146 |

| 2008 | 6.920 | 199.504 | 3.639 | 137.605 | 73.927 |

| 2009 | 7.500 | 197.110 | 3.857 | 146.154 | 77.609 |

| 2010 | 9.117 | 228.275 | 5.128 | 167.966 | 193.060 |

| 2011 | 10.127 | 220.577 | 3.641 | 165.473 | 152.107 |

| 2012 | 11.779 | 238.212 | 4.869 | 179.804 | 156.619 |

| 2013 | 10.914 | 240.277 | 5.251 | 187.131 | 119.115 |

| 2014 | 11.110 | 275.297 | 6.059 | 217.529 | 47.972 |

| 2015 | 12.320 | 317.433 | 5.715 | 243.764 | 277.713 |

| 2016 | 14.158 | 492.252 | 17.314 | 319.772 | 582.111 |

| 2017 | 7.882 | 103.365 | 6.834 | 11.811 | 62.867 |

| 2018 | 1.206 | 113.615 | 7.346 | 335.195 | 6.741 |

| 2019 | 1.230 | 122.427 | 1.956 | 389.860 | 7.395 |

| 2020 | 1.378 | 123.179 | 3.897 | 63.816 | 10.101 |

Sources:

- Central Bank of Egypt, Monthly Quarterly Bulletin for Various Years.

- Central Bank of Egypt, Financial Stability Report for Various Years.

The index continued to fluctuate in the years 2019 and 2020, with assets rising to $1.230 million and $1.378 million respectively. This was attributed to the Egyptian economy’s ability to contain the impact on foreign currency flows due to stable foreign currency sources, a substantial reserve, enabling it to mitigate the crisis repercussions in 2020. This, in turn, helped alleviate exchange rate pressures, reduce risks for the banking sector, and prevent the formation of risks associated with fluctuations in foreign capital, bolstering financial stability without resorting to full precautionary policy activation. (Central Bank of Egypt, 2019, p. 1)

Figure (1): Asset Index

Source: Compiled by the researchers based on data from Table (1).

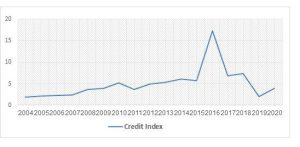

- Credit Index : It is considered one of the indicators of financial stability, represented by loans from banks and the government, often in the form of treasury bills and possibly bonds. (Al-Ali, 2020, p. 2)

Upon observing Table (1), we note a gradual increase in credit except for some years from 2005 to 2010, showing a continuous uptrend. Consequently, the banking system has witnessed positive developments and a rise in net financial positions due to the implementation of banking reform programs for the Egyptian financial sector and the opening of bank accounts to establish projects that enhance the stability and efficiency of the financial system. ( Central Bank of Egypt, 2010-2011, , p. B)

The index remained volatile in subsequent years, fluctuating between highs and lows due to economic and political instability. Despite the COVID-19 pandemic, the index began a gradual ascent in 2020, attributed to the Egyptian economy’s resilience in absorbing the pandemic’s impact on foreign currency reserves. This alleviated exchange rate pressures, reduced financial risks for the banking sector, and enabled the Egyptian economy to weather the crisis by leveraging diverse sources of foreign currency inflows. This resilience allowed it to navigate the crisis effects throughout 2020, as previously mentioned.

Figure (2): Credit Index

Source: Prepared by the researchers based on table data (1).

- Deposit Index: It is one of the significant indicators of financial stability, reflecting the liabilities aspect for the central bank’s balance sheet.

Through monitoring Table (1), it is evident that the indicators have been continuously increasing since 2004 until 2011 due to the Central Bank’s comprehensive financial and administrative restructuring, and the enhancement of risk management across all fronts to achieve financial stability, ensure the safety of the banking system, and enhance its competitiveness. (Central Bank of Egypt,2011-2012, pp. 28-29)

However, there was a noticeable decrease in the subsequent years. The index resumed its upward trend in the years 2018 and 2019 due to individuals’ confidence in the financial sector of the Central Bank of Egypt and the continuous efforts of the bank to improve the performance of its financial sectors to address the disruptions caused by the repercussions of the COVID-19 pandemic. In the year 2020, deposits decreased to $63.816 million due to curfews and the negative disruptions of the COVID-19 pandemic, despite the Central Bank’s implementation of all necessary measures to maintain financial safety indicators. (Central Bank of Egypt, 2019, p. 1)

Figure (3): Deposit Index

Source: Prepared by the researchers based on table data (1).

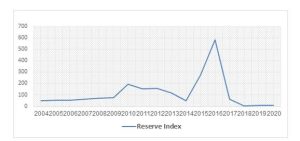

- Reserve Index: One of the important financial stability indicators is the reserve aspect of the central bank’s budget. Observing Table (1), we note that the index increased from 2004 to 2010, then started to decline in 2011 due to the January 25, 2011 revolution. The index resumed its rise in 2012 to reach $156.619 million. The reason for this increase is that the Central Bank prevented the repercussions of this crisis shock from reaching the financial system. Despite the decline in revenues and investments, the remittances of Egyptians abroad and the policy of the Central Bank of building a large net of reserves helped to withstand the shock, and the exchange rate was not affected at its level before the revolution and because the Central Bank continued its successful management. (Central Bank of Egypt,2012-2013, p. 62)

However, for the subsequent years, the index fluctuated between increases and decreases. The index continued to decline from 2018 to 2020 due to investment outflows and the reversal of positive expectations to negative, impacting the economy negatively, which reflected in the decrease of foreign currency assets.

Figure (4): Reserve Index

Source: Prepared by the researchers based on table data (1).

Secondly: Performance Indicators of the Egyptian Stock Market

We will now discuss the most important indicators used to evaluate the performance of the Egyptian stock market through data analysis and understanding the general market trends. The most important ones include:

- Trading Volume Index: It is the value of shares traded in the market hall at various prices during the period.

We notice from tracking the trajectory of this index through Table (1) that the index is continuously increasing due to the introduction of new systems and financial instruments during these years. One of the most important of these systems and instruments is the implementation of a system for trading securities bought and sold through electronic trading and the internet network, as well as the issuance of a number of shares and their introduction for trading. (Central Bank of Egypt, 2005-2006, p. 87)

In the years 2009, 2010, and 2011, trading volume decreased, only to rebound in 2012 due to the rise in financial market indices and the decline in the dollar’s value, which significantly impacted the financial markets, particularly the Egyptian economy. (Central Bank of Egypt,2013-2014, , p. J)

It continued to fluctuate, as shown in the table, between increases and decreases until it rose again in the years 2019 and 2020. This was the result of providing more protection to investors, including small shareholders, improving infrastructure indices, enhancing innovation capacity, increasing market volume transactions, and expanding the labor market. (Central Bank of Egypt, 2018-2019, p. J)

Figure (5): Trading Volume Index

Source: Prepared by the researchers based on table data (1).

- Market Capitalization Index: It is the closing price of the company’s stock at the end of the period. (Arab Monetary Fund, 2006, p. 3)

When tracking the path of Table (1), we notice that the market value index rises once and falls again, meaning that it is in a continuous fluctuation according to the economic and political conditions of the country and the extent to which it is affected by external and internal events and crises. This is confirmed by the tracking of Table (1), as the volume of fluctuations shows up and down to (2019), where it witnessed an increase reaching $42,358 million with a growth rate of 1.3%. The reason for this increase is the support provided to investors through granting them protection and increasing transactions in the financial market due to improvements in infrastructure.(Central Bank of Egypt,2019-2020, p. J)

In the year 2020, the index declined to $41,195 million with a rate of -2.7% due to the COVID-19 pandemic and the downturn in the financial markets resulting from the weakened activities of foreign investors, despite the discovery of the vaccine.

Figure (6): Market Capitalization Index

Source: Prepared by the researchers based on table data (1).

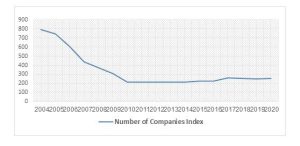

- Number of Companies Index: The number of companies listed on the Egyptian stock exchange, as tracked in Table (1), shows a continuous decline from 2005 to 2010. This is due to the decreasing activity in the Gulf financial markets, leading Gulf investors to divest and reduce their investments in the Egyptian stock exchange to cover their financial positions, which are primarily dependent on bank loans. They also faced selling pressures due to profit-taking operations. (Central Bank of Egypt, 2005-2006 , p. 88)

However, in 2011, the number of companies index witnessed a slight increase, reaching 214 companies with a growth rate of 0.9%. The reason for this increase is the activation of the role of small and medium-sized enterprises (SMEs), which is of significant importance in supporting the Egyptian economy under the current circumstances of the country. This was achieved through a decision issued by the Board of Directors of the Egyptian Financial Supervisory Authority, Decision No. 738, regarding the rules for regulating and supervising SMEs, as well as the issuance of Decisions No. 81 and 83 for the year 2011 regarding the rules for listing securities and transferring them from the Authority to the stock exchange. (Central Bank of Egypt, 2011-2012, p. 97)

Through the Egyptian Stock Exchange’s commitment to implementing a marketing policy aimed at attracting new companies to list, the council approved exempting company members from the initial listing fees.

The number of listed companies remained fluctuating until 2020, where it increased to 256 companies, with a growth rate of 3.2%. The reason for the increase in the number of companies was the Egyptian Stock Exchange’s adoption of several measures, including requiring brokerage firms’ employees not to attend trading halls and work remotely to avoid gatherings. Precautionary measures were applied to ensure the safety of workers, allowing stock exchange companies to receive client orders via email and text messages using mobile phones, provided that this is stipulated in the contract with clients. Additionally, the exchange developed its system through the implementation of the electronic voting system (E-Magles)* to enable all companies to hold board meetings and general assemblies, and reduced trading hours in line with curfews and their reinstatement according to the scheduled times. During 2020, the exchange aimed to support all aspects and take all necessary measures suitable for the challenging circumstances caused by the COVID-19 pandemic, which significantly affected financial markets worldwide. (Egyptian Stock Exchange, 2020, p. 14)

Figure (7): Number of Companies Index

Source: Prepared by the researchers based on table data (1).

Section Three: Measurement and Analysis of the Relationship Between Some Central Bank Indicators and Some Financial Market Indicators in Egypt During the Period (2004-2020)

Firstly: Description of the Standard Model

- Description of the Standard Model:

In this section, we will illustrate the impact of certain central bank indicators as independent variables on some financial market indicators as dependent variables in Egypt for the period (2004-2020), and their interrelationships using the statistical software (EViews 9). This can be described in the following table (Table 1):

Table (2): Variables of the rigorous model

| Variable Name | Symbol | Type |

| Assets | FINS | Independent |

| Credit | CRES | Dependent |

| Deposits | DEPS | Dependent |

| Trading Volume | TRVS | Dependent |

| Number of Companies | NUCS | Dependent |

| Nominal Share Value | MRVS | Dependent |

- Model Data: The study relied on time series data consisting of (68) observations for the period (2004-2020). These data were obtained from the (Central Bank of Egypt, Arab Monetary Fund), and their amounts are denominated in Egyptian pounds.

Secondly: Measurement and analysis of the relationship between certain Central Bank indicators and some financial market indicators in Egypt during the period (2004 – 2020):

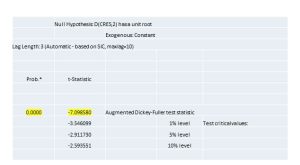

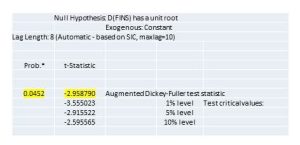

- Stability: Through Table (3) below, we observe that the independent variable (CERS) (Credit) has stabilized at the second difference with only a constant present and at a significance level of (1%).

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Table (3): Expanded Dickey-Fuller Test Results for Stability

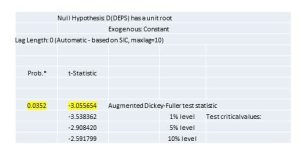

Through Table (4), we observe that the independent variable (DEPS), representing deposits, has stabilized at the first difference with only a constant present and at a significance level of (1%).

Table (4): Dickey-Fuller Test Results for the Independent Variable (DEPS)

Through Table (5), we notice that the independent variable (FINS) (Assets) has stabilized at the first difference with only a constant present and at a significance level of (1%).

Table (5): Dickey-Fuller Test Results for the Independent Variable (FINS)

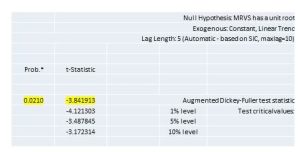

Through Table (6), we observe that the dependent variable (MRVS) (Market Value per Share) has stabilized at the level with a constant and a general trend present, at a significance level of (1%).

Table (6): Dickey-Fuller Test Results for the Dependent Variable (MRVS)

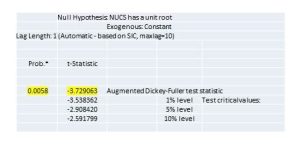

Through Table (7), we observe that the dependent variable (NUCS) (Number of Companies) has stabilized at the level with only a constant present and at a significance level of (1%).

Table (7): Dickey-Fuller Test Results for the Dependent Variable (NUCS)

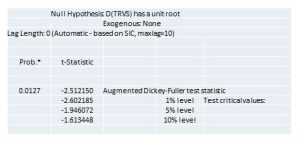

Through Table (8), we notice that the dependent variable (TRVS) (Trading Volume) has stabilized at the first difference without a constant or trend present, at a significance level of (1%).

Table (8): Dickey-Fuller Test Results for the Dependent Variable (TRVS)

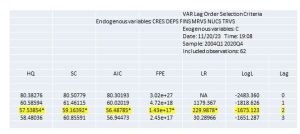

- Determination of the Optimal Time Lags: Through Table (9), we observe that the optimal number of time lags is two, based on the Schwarz criterion (SC), Akaike criterion (AIC), and Hannan-Quinn criterion (HQ).

Table (9): Results of Determining the Optimal Number of Time Lags for the Standard Model

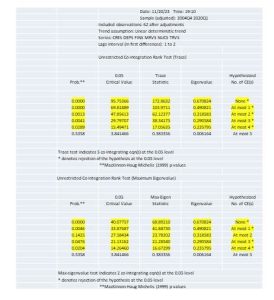

- Co-integration: Through Table (10) below, we notice the presence of (5) co-integrating vectors in the Trace test, as well as five co-integrating vectors in the Maximum Eigenvalue test. This indicates the existence of long-term co-integration relationship among the variables of the standard model.

Table (10): Johansen C. Co-integration Test Results

- Diagnostic Tests for the Standard Model:

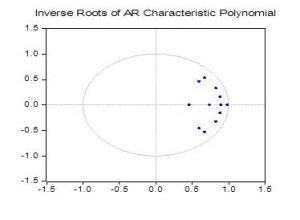

Stability Test of the Standard Model as a Whole: Through Figure (8), we notice that all the roots fall within the unit circle, indicating the stability of the standard model as a whole.

Figure (8): Stability Test of the Standard Model as a Whole

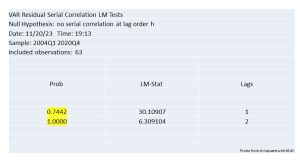

- Autocorrelation Test: Through Table (11), we notice that the values of Prob appeared as follows: (0.744, 1), which are greater than (0.05). In this test, only insignificance is observed, indicating no autocorrelation problem among the variables of our standard model.

Table (11): LM Test Results for Autocorrelation

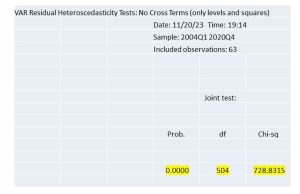

- Test for Heteroscedasticity: Through Table (12), we observe that the value of Prob appeared as (0.0000), which is significant as it is less than (0.05). This indicates that our standard model is free from heteroscedasticity issue among its variables.

Table (12): Results of Heteroscedasticity Test

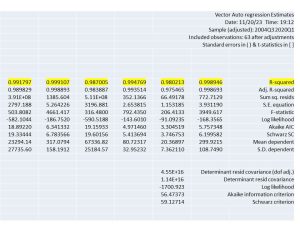

- Toda-Yamamoto Causality Model: Since some variables of the standard model have stabilized at the first difference, some at the level, and others at the second difference, and given that a long-term co-integration relationship has been found among the variables of our standard model, the best standard model to use in measuring and analyzing the relationship between the independent variables (indicators of the Central Bank of Egypt) and the dependent variables (indicators of the Egyptian financial markets) is the Toda-Yamamoto causality model. However, accessing this standard model can only be achieved by entering the Vector Auto regression (VAR) model.

We notice from Table (13) that all the values of R-squared appeared as (0.99), indicating that the independent variables (indicators of the Central Bank) explain (99%) of the variation in the dependent variables (indicators of the financial markets), while the remaining (1%) represents other factors not included in the standard model, which the researcher deemed unnecessary to consider. This indicates that the researcher was successful in choosing their standard model.

Table (13): Results of the VAR Model

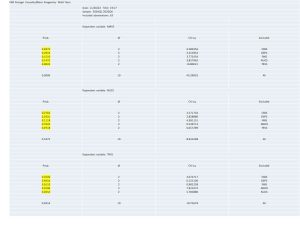

As we can see from Table (14), which highlights the results of using the Toda-Yamamoto model, all the Prob values for the independent variables (FINS, DEPS, CRES) appeared to be greater than (0.05). This indicates that these selected indicators for the Central Bank of Egypt do not have a significant impact on the selected indicators for the Egyptian stock market (TRVS, NUCS, MRVS). Therefore, the main research hypothesis, which states the existence of a direct and positive impact of Central Bank indicators on the Egyptian financial markets’ indicators for the period (2004-2020), will be rejected.

Table (14): Results of the Toda-Yamamoto Causality Model

Conclusions:

Firstly: Theoretical Aspect:

- The flexibility and adaptability of the banking system to crises, preventing their spread to the Egyptian financial system, can be attributed to the improvement and stability of its indicators. The efficiency of the banking system has increased, leading to enhanced investor confidence and attracting domestic and foreign capital.

- The Egyptian banking system demonstrated high absorptive capacity during the COVID-19 pandemic, contributing to the reduction of risks associated with fluctuations in capital flows, thereby reinforcing the stability of financial markets in Egypt.

- The Egyptian economy has successfully faced the repercussions of foreign currency flows due to its diverse sources, enabling it to effectively address the consequences of financial crises.

Secondly: Practical Aspect:

- All values of R-squared for the estimated model appeared to be 0.99, indicating that the independent variables of the Central Bank explain 99% of the variation in the dependent variables of the financial markets. The remaining 1% can be attributed to other factors not included in the standard model.

- The probability values appeared to be 0.000, indicating the significance of the model as they are less than 0.05. This suggests that the standard model is free from heteroscedasticity issue among its variables.

- The presence of a long-term co-integration relationship among the variables of the standard model.

Recommendations:

In light of the conclusions drawn, we can recommend the following:

- Enhancing the efficiency of financial markets by focusing on infrastructure development and updating legislation and regulations to better serve market operations.

- Supporting banks by issuing necessary laws to protect them and enhance their ability to withstand sudden crises. Banks should maintain a significant amount of cash liquidity to ensure financial stability, while also encouraging deposit mobilization to increase credit availability.

- Encouraging both local and foreign savings to provide investment opportunities for active participation in improving the efficiency of financial markets through diversification of financial instruments.

References

- Books

- Al-Monoufi A. A., 2021, “The Role of the Central Bank of Egypt in Achieving Monetary Stability,” Dar Al-Uloom University, Cairo.

- Sultan S. J., 2021, A Modern Perspective on Egyptian Banks, Azbakeya Printing House.

- Tantawi A. Johar A., 2020, The Impact of Foreign Direct Investments on Egyptian Banks for the Period (2010-2021), Cairo University Press.

- El-Abirsh M. M., 2022, The Role of Egyptian Monetary Policy in Achieving Sustainable Development, Al-Asriya Printing Press, Egypt – Banha.

- Journals

- Saad M. M., 2013, The Effectiveness of Financial and Monetary Policies in Stimulating Financial Markets, Journal of Legal and Economic Research, Issue 54.

- Conferences and reports:

- Al-Ali A. B., 2019-2020, “Money and its Quantitative Relationships in Iraq”, Lectures delivered to doctoral students, University of Karbala.

- The Central Bank of Egypt, Annual Report (2011–2012)

- Central Bank of Egypt, Financial Stability, 2019.

- Central Bank of Egypt, Annual Report, 2010-2011.

- Central Bank of Egypt, Annual Report (2012-2013).

- Central Bank of Egypt, Annual Report (2005-2006).

- Central Bank of Egypt, Annual Report (2013-2014).

- Central Bank of Egypt, Annual Report (2018-2019).

- Arab Monetary Fund, Arab Stock Markets Database, Quarterly Bulletin, 2006.

- Egyptian Stock Exchange, Annual Report, 2020.